The meeting between China’s Vice Premier He Lifeng and U.S. Treasury Secretary Janet Yellen is a significant moment for global trade, especially in the context of the ongoing China-U.S. trade negotiations. Both countries are grappling with challenging economic issues. Their discussions could lead to changes in tariff rules and how China and the U.S. collaborate on trade. Recent data regarding China’s economy has raised new questions about its strength. Key points include:

-

Official growth numbers don’t align with underlying economic problems, causing concerns.

-

An excess of factories and a weaker RMB are impacting trade partners.

-

China recognizes the need to adjust its policies, indicating a new plan.

These challenges, combined with the U.S. emphasis on fair trade, underscore the importance of this meeting. The outcomes could influence not only their trade relationship but also the global economic recovery.

Key Takeaways

-

The meeting between He Lifeng and Janet Yellen is important for fixing trade problems and tariff rules between China and the U.S.

-

China’s economic troubles, like too many factories and weak money value, need new plans to improve trade ties.

-

Tariffs have made things cost more for buyers and caused market confusion, showing the need for steady trade rules.

-

Experts think small tariff cuts might happen by 2025, but big changes will need more talks.

-

Better trade between China and the U.S. could help the world economy and stop problems that slow growth.

Background and Context

Overview of the Meeting

The meeting between China’s Vice Premier He Lifeng and U.S. Treasury Secretary Janet Yellen is very important. They want to solve trade problems and improve their relationship. This happens while the world economy is still weak. Fixing tariff issues is now more urgent than ever. They plan to talk about lowering trade barriers, helping both economies grow, and fixing deeper problems.

Historical Trade Tensions Between China and the U.S.

China and the U.S. have had trade problems for a long time. The trade war started in 2018 with high tariffs on both sides. For example:

-

The U.S. raised tariffs on Chinese goods to 145%. China added 84% tariffs on U.S. goods.

-

Big U.S. companies worried about the harm these tariffs caused.

These tariffs had big effects. Studies show U.S. importers paid most of the costs. Prices of Chinese goods didn’t change much. U.S. imports from Mexico went up as imports from China dropped. Here’s a table showing key data:

|

Year |

US Goods Imports from China (in billions) |

|---|---|

|

2001 |

100 |

|

2023 |

400 |

Even with tariffs, the U.S. trade deficit with China grew in 2018. This shows tariffs didn’t fix trade imbalances.

China’s Response to U.S. Tariffs

China fought back against U.S. tariffs with its own actions. It added tariffs on U.S. goods like soybeans, which hurt trade. China also made stronger trade deals with countries like Brazil to reduce the damage.

China’s trade plans have changed over time. Since joining the WTO in 2001, it worked on reforms and cutting tariffs. But recent global tensions made China rethink its strategies. Now, it focuses on being strong and trading with more countries. This helps protect its economy in a tough global market.

China’s Stance on Trade and Tariffs

Commitment to National Interests

China focuses on protecting its economy and independence in trade. It wants to rely less on other countries and grow its own industries. The government supports important areas like technology and manufacturing. This helps China stay strong and create new ideas at home.

To do this, China gives money to key industries and rewards for new technology. These steps help it compete better in the world. For example, the “Made in China 2025” plan shows China’s goal to lead in high-tech fields. This plan helps keep its economy strong for the future.

Note: China’s focus on its own needs affects its talks with the U.S. It tries to work together but also stay independent.

Principles of Mutual Respect, Equality, and Fairness

China believes trade should be fair and respectful for everyone. These ideas guide its deals with other countries. History shows this focus on fairness:

|

Date |

Example |

|---|---|

|

February 28, 1972 |

The Shanghai Communique supported equal trade for shared benefits. |

|

1918 |

Woodrow Wilson’s plan called for fair trade rules worldwide. |

|

February 6, 1938 |

Cordell Hull said fair trade brings peace and shared success. |

China wants trade deals that are good for all sides. By being fair, it builds trust with partners like the U.S. This helps keep trade steady and reliable.

Structural Reforms and Economic Strategy

China has changed its economy over time to fix problems and grow. It works on making its markets better and more efficient. In the past, moving from farming to cities caused some issues. To solve these, China focuses on improving how businesses and markets work.

In the late 1970s, China opened its economy to the world. Special zones and joint projects helped it grow fast. Changes in farming and city rules also helped build today’s economy.

Still, there are problems. State-run companies make competition harder. Also, China needs to improve in creating new ideas and opening trade. Fixing these will help China stay strong in global trade.

U.S. Perspective on Tariff Policies

Concerns Over Trade Deficits

The U.S. has struggled with trade deficits for years. This means it imports more than it exports, which worries economists. Big government spending, a strong dollar, and a growing economy make this worse. Since 2000, the U.S. trade deficit has averaged $594 billion, much higher than before. Experts warn this could lead to too much debt and financial problems.

|

Year |

U.S. Trade Deficit (in billions) |

GDP Percentage |

|---|---|---|

|

2022 |

944 |

3.7% |

|

2023 |

918.4 |

3.1% |

|

2000 |

594 |

< 2% |

Buying more goods from China has hurt U.S. factories and caused job losses. This has sparked debates about whether tariffs help fix trade deficits. Economist Joseph E. Gagnon says tariffs don’t work well. He explains they can cause inflation, hurt productivity, and create uncertainty. Tariffs also make the dollar stronger, which raises export prices and cancels out benefits.

Impact of Tariffs on Domestic and Global Economies

Tariffs affect both local and global economies in big ways. They make imported goods cost more, which raises prices for shoppers. For example, Amiti et al. (2019) found that U.S. consumers pay the full cost of tariffs. This increases prices and changes wages and trade patterns.

|

Study |

Findings |

|---|---|

|

Amiti et al. 2019 |

Tariffs raise prices for U.S. consumers. |

|

Fajgelbaum et al. 2019 |

Tariffs quickly increase consumer costs. |

|

Furceri et al. 2022 |

Tariffs don’t improve overall trade balances much. |

Globally, tariffs mess up supply chains and trade flows. They shift costs to foreign producers but rarely meet their goals. History shows tariffs often lead to higher prices, fewer jobs, and slower growth. Many experts suggest free trade policies instead, which usually help economies grow.

Potential Policy Adjustments

The U.S. Treasury knows tariff policies need changes. Unpredictable tariffs have made businesses uncertain and hurt consumer confidence. Still, some shoppers are buying durable goods now to avoid future price hikes.

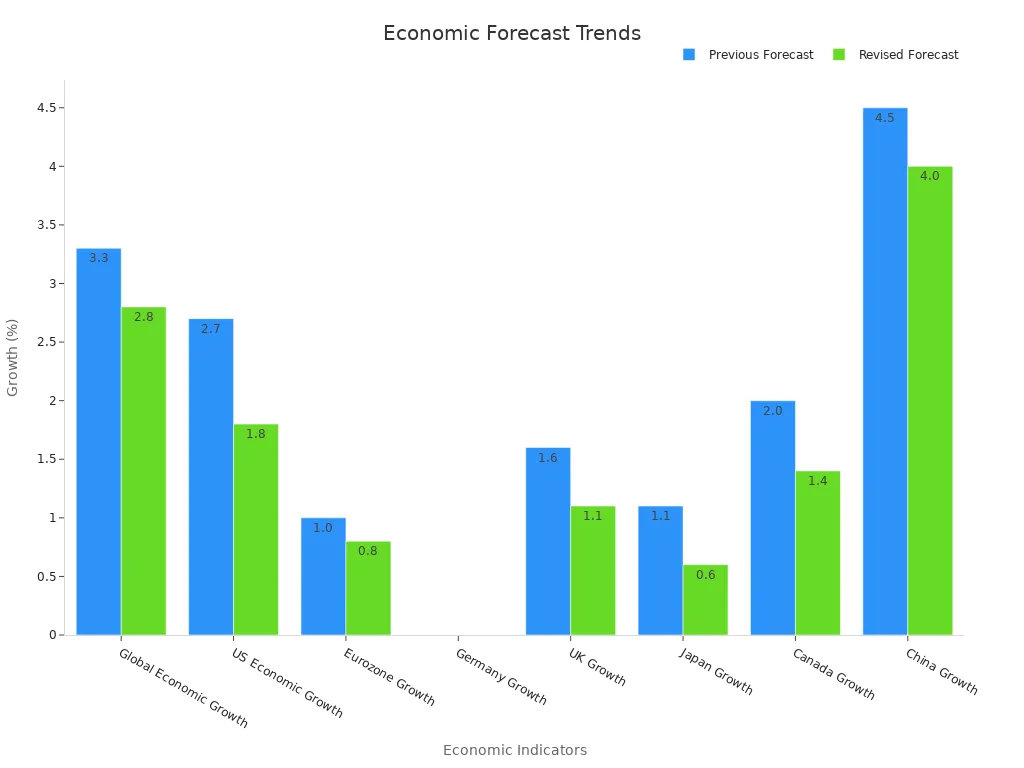

|

Indicator |

Previous Forecast |

Revised Forecast |

|---|---|---|

|

Global Economic Growth |

3.3% |

2.8% |

|

U.S. Economic Growth |

2.7% |

1.8% |

|

Eurozone Growth |

1.0% |

0.8% |

|

China Growth |

4.5% |

4.0% |

Experts predict slower global growth, with U.S. GDP dropping to 1.1% by 2025. This shows why the U.S. must act fast to fix trade issues. By working with China, the U.S. can create fairer trade policies and reduce uncertainty. This could lead to a stronger and more balanced economy.

Expert Analysis and Predictions

Problems in Making a Full Trade Deal

Experts say it’s hard for China and the U.S. to agree on a full trade deal. Economic models help show possible results but often miss real-life details. In developing countries, bad data makes these models less reliable. Other issues, like rules and subsidies, are also hard to measure. This makes trade talks even tougher.

Both countries have their own problems at home. The U.S. must balance money issues with politics. China focuses on protecting its economy. These different goals cause disagreements and slow down progress. Without fixing these big problems, a full trade deal will stay out of reach.

Predictions for Lower Tariffs by 2025

Experts think tariffs might go down a little by mid-2025. These changes will likely be small and temporary to avoid big problems. Here’s a table showing possible outcomes:

|

Scenario |

Best Tariff Rate |

GDP Effect |

|---|---|---|

|

No Retaliation |

20% |

N/A |

|

1-for-1 Retaliation |

10% |

-0.4% to -0.9% |

|

Current Effective Rate |

2.4% |

Positive GDP Growth |

The most likely case is that both countries will avoid big fights. They’ll work together to ease economic problems. This plan could help global trade and recovery.

Effects on China’s Economic Changes

China’s economic changes may face more problems with new tariffs. Current plans haven’t fixed weak spots in its economy. For example, more companies are losing money, and prices for goods are dropping. Key numbers show this:

|

Indicator |

2023 Value |

2024 Value |

|---|---|---|

|

Loss-making companies |

21% |

23% |

|

Producer price index decline |

Ongoing |

Ongoing |

|

Export prices decline |

Since May 2023 |

N/A |

These problems could change trade and hurt the global economy by -1.2%. To fix this, China might need to speed up changes in state-run businesses. Improving markets could make China stronger in trade and fix its economy.

Broader Implications for Global Trade

Effects on Multilateral Trade Agreements

The meeting between He Lifeng and Janet Yellen might change global trade deals. China and the U.S., as the biggest economies, have a big influence. Their talks could inspire fairer trade rules for other countries. But, trade benefits are not shared equally everywhere. A report called “The Distributional Impacts of Trade” says trade helps economies grow and reduces poverty, especially in poorer countries. Still, some areas or industries gain more than others. Leaders need to fix these gaps so everyone benefits from trade agreements.

Role of Structural Reforms in China’s Economic Strategy

China’s economic changes are key to its global trade plans. It wants to focus on new ideas and rely less on state-run companies. These changes aim to make China stronger and grow steadily. But, problems like weak industries and falling export prices remain. Speeding up these changes could help China in global trade deals. Working with the U.S. on trade might also help China fix its weaknesses and improve its strategies.

Potential for Improved Sino-U.S. Trade Relations

This meeting could improve trade ties between China and the U.S. Their relationship has been tense due to tariffs and trade fights. Recent talks in Geneva show both sides want to work together. Experts don’t expect big changes soon, but small steps like lowering tariffs could happen. The U.S. wants to fix its trade deficit, while China wants fairer treatment. Progress here could help both countries and the world economy.

The meeting between He Lifeng and Janet Yellen is important. It can help reduce trade problems and change tariff rules. Working together may stop the world economy from splitting into groups. The WTO says this split could lower global GDP by 7%. By 2025, global trade might drop by 0.2%. North America’s GDP could shrink by 1.6%, and Asia’s by 0.4%. If both countries focus on fairness and respect, they can create better global trade relationships.

Why is the He Lifeng and Janet Yellen meeting important?

This meeting is crucial for global trade. It focuses on fixing trade problems and tariff rules between China and the U.S. Their talks might help the world economy recover and improve their relationship.

How do tariffs affect people and businesses?

Tariffs make imported goods cost more, raising prices for shoppers. Businesses face higher costs and supply chain problems, which can hurt profits and make them less competitive.

Tip: Using different suppliers can help businesses handle tariff issues better.

Will tariffs be lowered right away after the meeting?

Experts think only small tariff changes will happen by 2025. Both countries want to avoid big problems while fixing trade issues. Major changes will take longer talks.

How does China’s trade plan impact the world?

China’s focus on improving its economy and creating new ideas helps its trade position. But problems like weak state-run companies and falling export prices could slow progress.

Why does the U.S. worry about trade deficits?

A trade deficit means the U.S. buys more than it sells, which can cause problems for the economy. The U.S. wants fair trade policies to fix this issue.

Note: Fixing trade deficits may need better local production and fair trade deals.

See Also

Key Features of SPC5605BMLL6 and SPC5607BMLL6 ECUs

Unveiling LPQ252-CEF: A Solution for Power Efficiency

Understanding MC9S12DJ256MFUE Specs for Automotive Use

MAX8647ETE+T: Boosting Display Quality in Smartphones

Three Key Innovations of XCF01SVOG20C in Automation