The consumer electronics market continues to grow at an extraordinary pace, fueled by advancements in technology and shifting consumer demands. In 2022, the market generated $987 billion in revenue, with telephony alone expected to surpass $661.4 billion by 2034. Innovations like 5G and IoT are reshaping how users interact with devices, while the global IoT market is projected to expand from $1.3 trillion in 2022 to $3.3 trillion by 2030. These trends underscore the increasing demand for connected devices, as well as the pivotal role of Consumer Electronics chips in powering modern gadgets.

Key Takeaways

-

Caring for the planet is a big trend in electronics. Companies now use eco-friendly ways to make greener products people want.

-

Shopping in many ways makes customers happier. Mixing online and in-store shopping helps businesses sell more and keep buyers interested.

-

Making things personal keeps customers happy. Companies that match products to what people like get more sales and loyal buyers.

-

Online shopping and using phones to shop are changing things. Businesses need to make their websites work well on phones to stay ahead.

-

5G is changing how we connect. It moves data faster and helps smart devices work better, making life easier for users.

Current and Emerging Market Trends in Consumer Electronics

Sustainability and Eco-Friendly Innovations

Sustainability has become a defining factor in the consumer electronics industry. Manufacturers are increasingly adopting eco-friendly practices to meet growing consumer demand for greener products. Over the past decade, product efficiency has improved by 70%, while many production facilities now operate entirely on renewable energy. These efforts have significantly reduced greenhouse gas emissions, with a reported decrease of 466,000 tons.

Legislation also plays a critical role in promoting sustainability. France’s Anti-Waste for a Circular Economy Act (AGEC), passed in 2020, mandates transparency regarding spare parts availability and bans built-in obsolescence techniques. Products must now display a reparability score, encouraging consumers to choose longer-lasting devices.

Consumers are also driving this trend. A 2023 survey by Neilson revealed that 73% of global consumers are willing to change their habits to reduce environmental impact. This shift in preferences underscores the importance of sustainability as a key market driver.

Growth of Omnichannel Retail Experiences

Omnichannel retailing has transformed how consumers interact with brands. By integrating online and offline channels, businesses create seamless shopping experiences that cater to modern consumer expectations. Omnichannel strategies have proven highly effective, with omnichannel customers shopping 1.7 times more than single-channel shoppers.

Despite its potential, only 8% of businesses have mastered omnichannel retailing. However, those that succeed see significant benefits. For instance, Zara experienced a 74% rise in online sales after adopting omnichannel marketing in 2020. Additionally, omnichannel businesses generate in-store visits from about 80% of their customers, highlighting its ability to drive foot traffic.

The consumer electronics market has embraced this trend, with brands leveraging omnichannel strategies to enhance customer engagement. As 87% of businesses recognize omnichannel as crucial for success, its adoption is expected to grow further, reshaping retail dynamics.

Expansion of eCommerce and Direct-to-Consumer Models

The rapid growth of eCommerce has revolutionized the consumer electronics market. Mobile commerce, in particular, has emerged as a dominant force, enabling consumers to shop conveniently from their smartphones. This shift has driven the expansion of marketplaces, with platforms like Amazon and Alibaba leading the charge.

Direct-to-consumer (DTC) models have also gained traction, allowing brands to establish direct relationships with their customers. By bypassing traditional retail channels, companies can offer personalized experiences and competitive pricing. This approach has proven especially effective in the consumer electronics sector, where customization and convenience are highly valued.

The rise of mobile commerce has further accelerated eCommerce expansion. Consumers increasingly rely on their mobile devices for shopping, making it essential for brands to optimize their platforms for mobile users. As a result, the integration of mobile commerce into eCommerce strategies has become a key focus for businesses aiming to stay competitive in this dynamic market.

The consumer electronics market continues to evolve, driven by trends like sustainability, omnichannel retailing, and eCommerce expansion. These developments highlight the industry’s adaptability and its commitment to meeting changing consumer needs.

Increasing Demand for Personalization and Customization

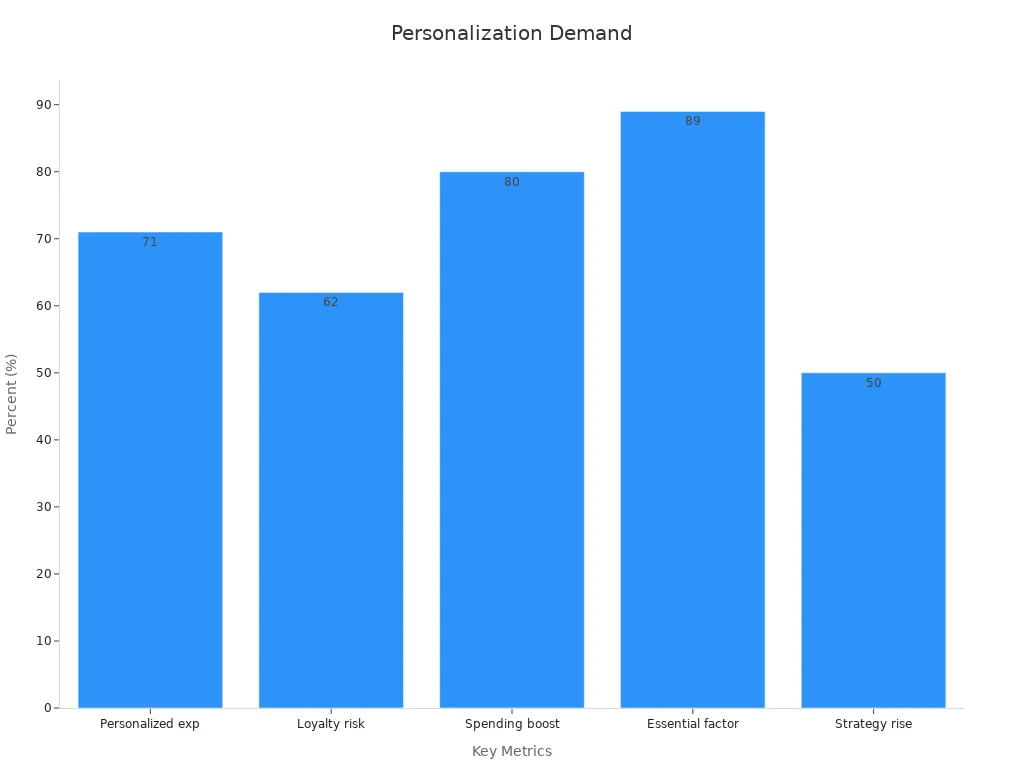

Personalization has become a cornerstone of the consumer electronics industry. Modern consumers expect products and services tailored to their unique preferences. This shift has driven brands to adopt advanced technologies like artificial intelligence and machine learning to deliver customized experiences. For instance, smart home devices now allow users to set personalized routines, while wearable technology offers health insights based on individual data.

A growing body of research highlights the importance of personalization. According to McKinsey, 71% of customers expect personalized experiences, while 62% of consumers lose loyalty to brands that fail to meet this expectation. Furthermore, businesses that prioritize personalization report an average increase of 38% in consumer spending. These statistics underscore the critical role of customization in driving customer satisfaction and revenue growth.

|

Statistic |

Source |

|---|---|

|

71% of customers expect personalized experiences. |

McKinsey |

|

62% of consumers say brands lose their loyalty if they provide un-personalized experiences. |

Segment |

|

80% of businesses report increased consumer spending (averaging 38% more) when their experiences are personalized. |

Twilio/Segment |

|

89% of marketing decision-makers consider personalization essential for their business’s success over the next three years. |

Segment |

|

Brands incorporating personalization as a core experience strategy has risen 50% since 2022. |

Deloitte Digital |

Brands are also leveraging data analytics to refine their personalization strategies. By analyzing consumer behavior, companies can predict preferences and offer tailored recommendations. For example, eCommerce marketplaces use algorithms to suggest products based on browsing history. This approach not only enhances the shopping experience but also fosters brand loyalty.

The demand for personalization reflects broader trends in consumer behavior. As technology evolves, the ability to customize products and services will likely become a standard expectation, reshaping the competitive landscape of the consumer electronics market.

Global Supply Chain Challenges and Adaptations

The global supply chain for consumer electronics faces unprecedented challenges. Disruptions caused by geopolitical tensions, natural disasters, and the COVID-19 pandemic have exposed vulnerabilities in traditional supply chain models. These issues have led to delays, increased costs, and reduced inventory levels, forcing companies to adapt.

Key metrics illustrate the impact of these challenges. For example, the inventory turnover ratio has declined, indicating slower movement of goods. Lead time visibility has also decreased, making it harder for companies to predict delivery times. Meanwhile, the mean time to recovery (MTTR) has increased, reflecting the longer duration required to address disruptions.

|

Metric |

Description |

|---|---|

|

Inventory Turnover Ratio |

Frequency of inventory sold and replaced over a period. |

|

Order Accuracy |

Percentage of orders delivered without errors. |

|

Lead Time Visibility |

Time taken from order placement to delivery. |

|

Delivery Reliability |

Consistency in on-time deliveries. |

|

Mean Time to Recovery (MTTR) |

Average time required to recover from a supply chain disruption. |

|

Supply Chain Visibility |

Ability to track and monitor supply chain activities. |

|

On-time In Full (OTIF) Delivery Rate |

Percentage of orders delivered in full and on time. |

|

Supply Chain Flexibility |

Ability to adjust to changes in demand or supply. |

|

Inventory Days of Supply |

Number of days an organization can meet customer orders without new inventory. |

|

Demand Forecast Accuracy |

Degree to which actual demand matches forecasted demand. |

|

Supplier Delivery Performance |

Measures how well suppliers meet delivery time commitments. |

|

Supply Chain Cost as a Percentage of Sales |

Total cost of managing the supply chain as a portion of sales revenue. |

|

Cash-to-Cash Cycle Time |

Time taken to convert investment in inventory back into cash. |

|

Supply Chain Planning Accuracy |

Accuracy of planning processes in predicting supply chain needs. |

To address these issues, companies are adopting innovative solutions. Supply chain visibility tools, powered by IoT and blockchain technology, enable real-time tracking of goods. This transparency helps businesses identify bottlenecks and optimize operations. Additionally, many firms are diversifying their supplier base to reduce dependency on a single region or vendor.

Another adaptation involves reshoring and nearshoring production facilities. By moving manufacturing closer to key markets, companies can mitigate risks associated with long-distance shipping. This strategy also aligns with sustainability goals, as it reduces the carbon footprint of transportation.

The consumer electronics market is also exploring flexible supply chain models. These models allow companies to respond quickly to changes in demand or supply. For instance, some brands are using predictive analytics to forecast demand more accurately, ensuring that inventory levels align with market needs.

Despite these adaptations, challenges persist. Rising raw material costs and labor shortages continue to strain supply chains. However, the industry’s resilience and commitment to innovation suggest that these obstacles can be overcome. As global supply chains evolve, they will play a crucial role in shaping the future of consumer electronics.

Major Product Categories in Consumer Electronics

Smartphones and Mobile Devices

Smartphones and mobile devices dominate the consumer electronics market, accounting for a significant portion of annual revenue. In 2024, mobile devices held a 57.28% market share, reflecting their essential role in modern life. This growth stems from advancements in 5G technology, enhanced camera systems, and improved battery performance. These innovations have made smartphones indispensable for communication, entertainment, and productivity.

The global smartphone market continues to expand, with a 3% year-over-year growth recorded in Q1 2025. Emerging markets, particularly in Asia, have driven this increase, supported by rising demand in China. Leading brands like Apple have capitalized on this trend, achieving a 19% market share in Q1 2025, their highest for that quarter. The rise of mobile applications and marketplaces has further fueled this growth, making smartphones a cornerstone of the consumer electronics industry.

Wearable Technology

Wearable technology has emerged as a rapidly growing segment within consumer electronics. In 2023, the wearable electronics market was valued at USD 144 billion, with projections indicating growth to USD 167.62 billion in 2024. By 2032, the market is expected to reach USD 564.86 billion, driven by a compound annual growth rate (CAGR) of 16.4%. This trajectory highlights the increasing adoption of wearables for health monitoring, fitness tracking, and lifestyle enhancement.

Regional data underscores the global appeal of wearables. North America holds 33.8% of the market share, followed by Europe at 25.4% and the Asia-Pacific region at 30.1%. These devices, ranging from smartwatches to fitness bands, have become integral to daily life. Their ability to provide real-time data and personalized insights aligns with broader trends in consumer electronics, emphasizing convenience and customization.

Smart Home Devices and IoT Gadgets

Smart home devices and IoT gadgets represent another key category in consumer electronics. The market size for these products is projected to grow from USD 151 billion in 2025 to USD 710.84 billion by 2034, with an impressive CAGR of 18.78%. This growth reflects the increasing demand for connected devices that enhance home automation, security, and energy efficiency.

Regional markets show significant potential. In 2024, the U.S. market size reached USD 35.66 billion, with projections of USD 199.39 billion by 2034. Similarly, the Asia-Pacific region is expected to grow from USD 38.39 billion in 2024 to USD 214.67 billion by 2034. These trends highlight the global shift toward smart living, driven by innovations in IoT technology and the integration of devices through centralized platforms.

Smart home products, such as voice-activated assistants, smart thermostats, and connected lighting systems, have transformed how consumers interact with their living spaces. Marketplaces play a crucial role in making these products accessible, offering a wide range of options to suit diverse needs and preferences.

Gaming Consoles and Accessories

Gaming consoles and accessories remain a cornerstone of the consumer electronics market. These products cater to a growing audience of gamers seeking immersive experiences and cutting-edge technology. The segment is projected to grow at a compound annual growth rate (CAGR) of 12.3% from 2024 to 2032, highlighting its robust expansion. In 2020, the gaming console market size exceeded USD 20 billion, with a forecasted growth rate of over 8% CAGR from 2021 to 2027. By 2025, global revenue from game consoles is expected to reach USD 24.8 billion, with an annual growth rate of 1.85% from 2025 to 2029.

|

Segment |

Market Share |

CAGR (%) |

Forecast Period |

|---|---|---|---|

|

Gaming Consoles |

Highest |

12.3 |

2024-2032 |

|

Gaming Console Market Size |

Exceeded USD 20 billion |

8 |

2021-2027 |

|

Game Consoles Revenue |

US$24.8bn |

1.85 |

2025-2029 |

The demand for gaming accessories, such as controllers, headsets, and external storage devices, complements the popularity of consoles. These products enhance gameplay and provide users with personalized setups. Innovations like haptic feedback in controllers and spatial audio in headsets elevate the gaming experience, making this category a vital part of the consumer electronics landscape.

Audio and Visual Equipment

Audio and visual equipment continues to evolve, driven by technological advancements and changing consumer preferences. Products like headphones, soundbars, and televisions dominate this category, offering high-quality audio and visual experiences. The market benefits from trends such as increased disposable income and the shift toward portable and wireless solutions.

-

The consumer audio equipment market is growing due to advancements in technology and rising disposable income.

-

Portable and wireless audio solutions are gaining popularity among consumers.

-

The education sector leads in adopting audio-visual tools, enhancing multimedia learning experiences.

-

North America remains the dominant region, driven by demand for quality audio experiences and innovations in audio technology.

The integration of advanced chips, such as the OPA1622 for ultra-low distortion and the LM833 for stereo sound processing, ensures superior performance in audio devices. Similarly, visual equipment like televisions incorporates cutting-edge display technologies, including OLED and QLED, to deliver stunning visuals. These products cater to diverse needs, from entertainment to professional applications, solidifying their importance in the consumer electronics market.

Laptops, Tablets, and PCs

Laptops, tablets, and PCs represent a dynamic segment within consumer electronics. These products serve as essential tools for work, education, and entertainment. The demand for portable computing devices has surged, driven by remote work trends and the need for flexible learning solutions.

Manufacturers focus on enhancing performance, battery life, and connectivity to meet consumer expectations. Chips like the TLV9062, designed for mobile audio and sensing, and the OPA333, optimized for portable electronics, play a crucial role in improving device functionality. Products in this category often feature lightweight designs, high-resolution displays, and powerful processors, making them indispensable for modern lifestyles.

The market also reflects a growing preference for hybrid devices, such as 2-in-1 laptops that combine the functionality of tablets and PCs. These innovations align with consumer demands for versatility and convenience. As technology advances, laptops, tablets, and PCs will continue to adapt, ensuring their relevance in an ever-changing landscape.

Leading Brands in the Consumer Electronics Market

Apple: Innovation and Ecosystem Integration

Apple stands as a pioneer in the consumer electronics industry, renowned for its innovation and seamless ecosystem. The company’s ability to integrate hardware, software, and services has set it apart from competitors. In 2023, Apple generated $81 billion in revenue from services, showcasing the strength of its ecosystem. Features like iCloud and Apple Pay enhance user convenience and foster loyalty. With a 92% customer retention rate, Apple has cultivated a dedicated user base.

Apple’s ecosystem encourages users to stay within its platform. Tools like Find My and iCloud Photos simplify device management and improve security. These integrations make switching to other brands challenging, especially for customers owning multiple Apple devices. In the U.S., Apple holds over 50% of the smartphone market share, reflecting its dominance in this category.

The company’s focus on multi-device compatibility also contributes to its success. Services like Maps and iWork apps provide consistent experiences across devices. This approach ensures that Apple remains a leader in consumer electronics, offering products that combine innovation with user-centric design.

|

Metric |

Value |

|---|---|

|

Revenue from Services |

$81 billion in 2023 |

|

Customer Retention Rate |

92% |

|

U.S. Smartphone Market Share |

Over 50% |

Samsung: Diversification and Cutting-Edge Technology

Samsung excels in diversification, offering a wide range of consumer electronics products. Its Galaxy series holds approximately 20% of the global smartphone market share, driven by advancements in camera systems and AI capabilities. The company also leads in display technology, developing flexible OLED displays and Quantum Dot technology.

Samsung’s product portfolio extends beyond smartphones. It is a major producer of memory chips and has adapted to global challenges by diversifying its supply chains. In home appliances, Samsung integrates AI-powered features, such as the SmartThings app, to enhance user convenience. The company’s AI Ecobubble technology in washing machines exemplifies its commitment to innovation.

Samsung’s leadership in 5G technology further strengthens its market position. This advancement impacts mobile communications and ensures faster connectivity for users. By maintaining a diversified portfolio, Samsung mitigates risks and capitalizes on growth opportunities across various sectors.

|

Sector |

Key Highlights |

|---|---|

|

Consumer Electronics |

Galaxy series holds ~20% global market share; advancements in camera systems and AI capabilities. |

|

Semiconductors |

Major producer of memory chips; adapting to US export restrictions by diversifying supply chains. |

|

Display Technology |

Innovations in OLED technology; development of flexible displays and Quantum Dot technology. |

|

Home Appliances |

AI-powered appliances enhancing user convenience; integration through SmartThings app. |

|

Information Technology |

Leadership in 5G technology impacting mobile communications market. |

Sony: Excellence in Entertainment and Gaming

Sony has established itself as a leader in entertainment and gaming within the consumer electronics market. The company’s gaming consoles, particularly the PlayStation series, have achieved remarkable success. Sony holds the distinction of producing the fastest-selling gaming console in history.

Sony’s dominance in the gaming industry stems from its ability to deliver immersive experiences. The company has consistently increased its market share since entering the gaming sector. Its consoles serve as platforms for high-quality games, attracting a loyal customer base.

Beyond gaming, Sony excels in home entertainment. Its televisions and audio equipment feature cutting-edge technology, catering to consumers seeking premium experiences. By focusing on innovation and quality, Sony continues to lead in entertainment and gaming, solidifying its position in the consumer electronics industry.

-

Sony is recognized as the leading provider in the gaming console market.

-

The PlayStation series is the fastest-selling tool in consumer electronics history.

-

Sony has increased its market share since entering the gaming industry.

Xiaomi: Affordable Innovation and Market Expansion

Xiaomi has established itself as a leader in affordable innovation within the consumer electronics market. The company’s strategy revolves around offering high-quality products at competitive prices, making advanced technology accessible to a broader audience. This approach has resonated with cost-conscious consumers, particularly in emerging markets.

Xiaomi’s pricing model focuses on low-margin, high-volume sales. This strategy has proven effective, with 70% of its customers citing affordability as a key factor in their purchasing decisions. By prioritizing cost-effectiveness, Xiaomi has built a strong market presence and gained a loyal customer base. The brand’s commitment to affordability extends to smart home solutions, where demand for budget-friendly innovations continues to rise.

The company’s success also stems from its ability to adapt to local markets. Xiaomi tailors its products and services to meet regional preferences, enhancing customer satisfaction. Approximately 60% of its global customers appreciate this focus on localization. For instance, in India, where the consumer electronics market is projected to grow at a CAGR of 7.5% from 2025 to 2035, Xiaomi has capitalized on increasing smartphone penetration and rising disposable incomes.

Xiaomi’s emphasis on affordability and market-specific customization has positioned it as a key player in the global consumer electronics industry. Its ability to balance innovation with cost-effectiveness ensures continued growth and relevance in diverse markets.

Amazon: Smart Home Leadership with Alexa

Amazon has emerged as a dominant force in smart home technology, driven by its Alexa-enabled devices. The company’s leadership in this space is evident through its commitment to enhancing user experiences and fostering device compatibility. Amazon supports the Matter initiative, which enables seamless integration between devices from different manufacturers. This effort simplifies smart home ecosystems and promotes interoperability.

The introduction of the Frustration Free Setup process further underscores Amazon’s focus on user convenience. This feature streamlines the installation of smart home devices, reducing complexity for consumers. Additionally, the Ambient Home Developer Kit allows developers to integrate Alexa’s capabilities more deeply, creating contextual and proactive smart home experiences.

Amazon’s dedication to innovation extends to its developer tools. At the Alexa Live Developer Event, the company unveiled new resources to assist developers in building Matter-compatible devices. The Alexa Home State API enhances functionality by supporting various modes, improving the overall smart home experience.

By prioritizing compatibility, ease of use, and developer support, Amazon has solidified its position as a leader in smart home technology. Alexa’s integration into daily life continues to shape the future of connected living.

Huawei: Pioneering 5G and Mobile Technology

Huawei has positioned itself as a pioneer in 5G and mobile technology, driving advancements that redefine connectivity. The company’s investments in research and development have enabled it to lead the global 5G market, providing faster and more reliable networks. Huawei’s 5G infrastructure supports a wide range of applications, from enhanced mobile experiences to industrial automation.

The brand’s focus on innovation extends to its mobile devices. Huawei integrates cutting-edge technology, such as advanced camera systems and AI-powered features, into its smartphones. These innovations cater to consumers seeking high-performance devices that enhance productivity and entertainment.

Huawei’s commitment to 5G technology has also influenced its approach to smart devices. By leveraging 5G connectivity, the company has developed products that offer seamless integration and improved functionality. This focus on connectivity ensures that Huawei remains at the forefront of technological advancements.

Huawei’s leadership in 5G and mobile technology highlights its role as a trailblazer in the consumer electronics industry. Its dedication to innovation and connectivity continues to shape the future of digital experiences.

Technology Dynamics Shaping the Consumer Electronics Industry

Artificial Intelligence (AI) and Machine Learning

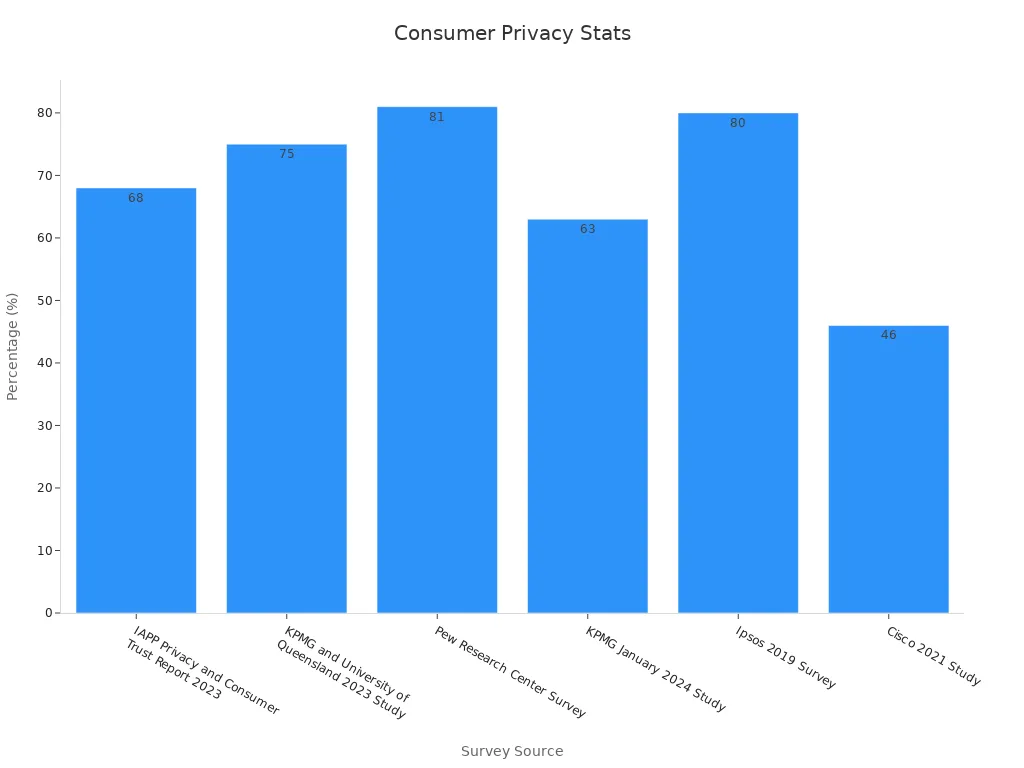

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the consumer electronics industry by enabling smarter, more intuitive devices. These technologies allow gadgets to learn from user behavior, adapt to preferences, and deliver personalized experiences. For example, AI-powered virtual assistants like Siri and Alexa can process natural language, making interactions more seamless. Similarly, ML algorithms in smartphones enhance camera performance by optimizing settings based on the environment.

Despite their benefits, AI and ML raise concerns about privacy and data security. A 2023 study by KPMG and the University of Queensland revealed that 75% of consumers globally worry about the risks associated with AI. Additionally, 81% of respondents in a Pew Research Center survey believe AI companies may misuse collected information. These statistics highlight the need for transparency and ethical practices in AI development.

|

Source |

Statistic |

Description |

|---|---|---|

|

IAPP Privacy and Consumer Trust Report 2023 |

68% |

Consumers globally concerned about their online privacy. |

|

KPMG and University of Queensland 2023 Study |

75% |

Consumers globally feel concerned about potential risks of AI. |

|

Pew Research Center Survey |

81% |

Consumers believe AI companies will misuse collected information. |

|

KPMG January 2024 Study |

63% |

Consumers concerned about generative AI compromising privacy. |

|

Ipsos 2019 Survey |

80% |

Respondents across 24 countries expressed concern about online privacy. |

|

Cisco 2021 Study |

46% |

Consumers feel unable to protect their personal data. |

AI and ML also play a critical role in enhancing energy efficiency. Smart home devices use AI to optimize energy consumption, reducing costs and environmental impact. As these technologies evolve, they will continue to shape the future of the consumer electronics industry, balancing innovation with ethical considerations.

Internet of Things (IoT) and Connected Devices

The Internet of Things (IoT) has revolutionized the consumer electronics market by connecting devices to create smarter ecosystems. IoT-enabled gadgets, such as smart thermostats and wearable fitness trackers, provide real-time data and automation. These devices enhance convenience and efficiency, making them indispensable in modern households.

The global IoT market in consumer electronics is projected to reach $172 billion by 2030, growing at a compound annual growth rate (CAGR) of 18% from 2020 to 2030. This growth reflects the increasing adoption of smart devices and the rising importance of security in connected ecosystems. Key drivers include the widespread use of the internet and the growing demand for personal IoT devices like wearables and smart home automation systems.

-

The global IoT market value in consumer electronics is projected to reach $172 billion by 2030, with a CAGR of 18% from 2020 to 2030.

-

Significant traction in the consumer electronics market due to increased Internet usage.

-

Adoption of smart devices and rising security concerns are major growth drivers.

-

Growing applications of personal IoT devices like wearables and smart home automation.

IoT also enhances supply chain visibility in the consumer electronics industry. By integrating IoT sensors, companies can track inventory and optimize logistics. This transparency reduces delays and improves customer satisfaction. As IoT technology advances, it will continue to drive innovation and efficiency across the industry.

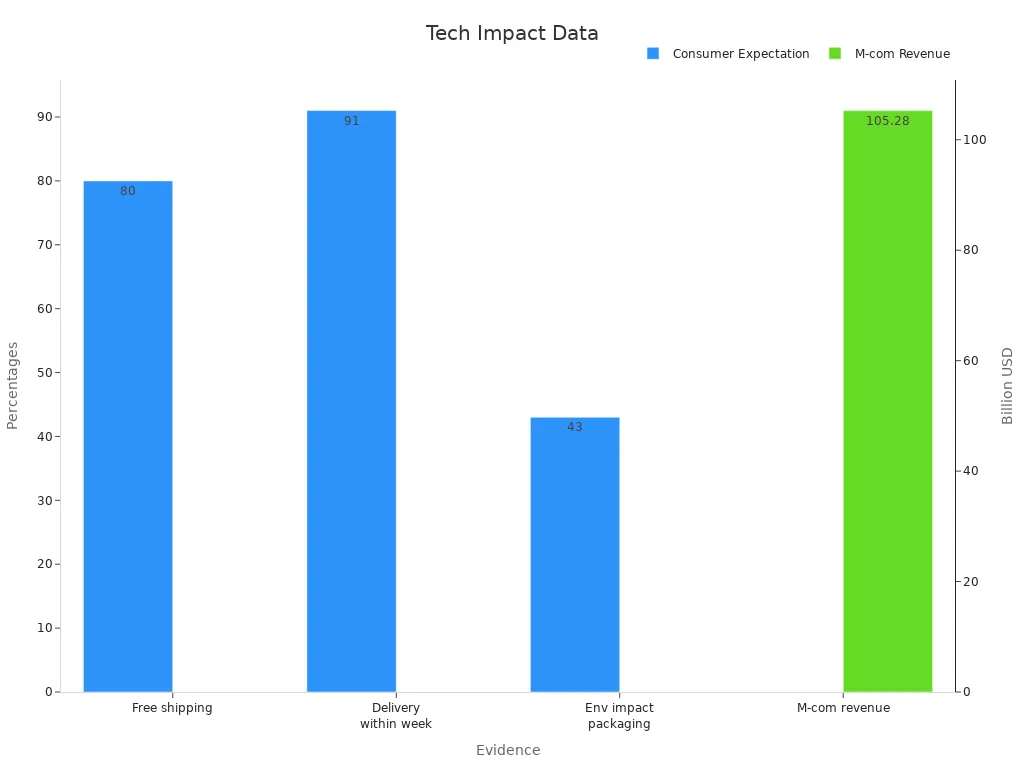

5G Connectivity and Its Impact on Devices

5G connectivity is reshaping the consumer electronics landscape by enabling faster and more reliable networks. This technology supports high-speed data transfer, low latency, and enhanced connectivity, making it ideal for applications like streaming, gaming, and smart home automation. Devices equipped with 5G capabilities offer improved performance, allowing users to enjoy seamless experiences.

The rollout of 5G networks has also accelerated the adoption of IoT devices. With faster connectivity, smart gadgets can communicate more efficiently, enhancing their functionality. For instance, 5G-enabled wearables provide real-time health monitoring, while smart home devices offer quicker response times. These advancements highlight the transformative impact of 5G on the consumer electronics industry.

Consumer expectations for connectivity have also evolved. A recent study found that 91% of consumers expect delivery within a week, while 80% prioritize free shipping. These preferences underscore the importance of efficient logistics, which 5G technology can support by improving supply chain operations.

|

Evidence Description |

Numerical Data |

|---|---|

|

Consumer expectation for free shipping |

80% |

|

Consumer expectation for delivery within a week |

91% |

|

Importance of environmental impact of packaging |

43% |

|

Projected m-commerce revenue in the UK by 2024 |

$105.28 billion |

As 5G technology becomes more widespread, it will unlock new possibilities for innovation. From augmented reality applications to autonomous vehicles, the potential of 5G extends far beyond consumer electronics. Its impact will continue to shape the industry, driving growth and enhancing user experiences.

Augmented Reality (AR) and Virtual Reality (VR)

Augmented Reality (AR) and Virtual Reality (VR) are revolutionizing the consumer electronics industry by creating immersive and interactive experiences. These technologies are no longer confined to niche markets. They are now integral to gaming, entertainment, education, and even healthcare. The global VR market, valued at $6.1 billion in 2020, is projected to grow at a compound annual growth rate (CAGR) of 44.3%, reaching $57.55 billion by 2027. Similarly, the AR market is expanding rapidly, driven by enterprise applications that enhance training and operational efficiency.

The gaming sector has emerged as a significant driver of VR adoption. By 2027, the virtual reality gaming market is expected to be worth $92.31 billion. Approximately 171 million people worldwide already use VR, highlighting its growing popularity. Beyond gaming, AR and VR are transforming how consumers interact with devices. For instance, AR-powered applications allow users to visualize furniture in their homes before purchasing, while VR headsets provide immersive movie-watching experiences.

Did you know? AR and VR combined could boost the global economy by $1.9 trillion by 2030. This growth underscores their potential to reshape industries and consumer habits.

The entertainment industry is also leveraging these technologies to enhance user experiences. VR headsets now offer 360-degree videos and virtual concerts, while AR applications bring interactive elements to live events. These advancements align with the broader trend of personalization in consumer electronics, as users seek tailored and engaging experiences.

Advancements in Battery Technology and Energy Efficiency

Advancements in battery technology are reshaping the consumer electronics landscape by addressing two critical challenges: energy efficiency and device longevity. Modern batteries now offer higher energy density, faster charging, and longer lifespans, making them indispensable for portable devices, electric vehicles (EVs), and renewable energy storage. For instance, battery energy density has increased from 250 Wh/kg in 2020 to a projected 500 Wh/kg by 2030, doubling the power capacity of devices.

Graphene batteries represent a breakthrough in charge cycles, offering three times the durability of traditional lithium-ion batteries. Silicon anodes further enhance capacity by 20-40%, enabling devices to run longer on a single charge. These innovations not only improve performance but also reduce environmental impact. Cobalt-free batteries, for example, lower production costs by 30% while minimizing reliance on rare earth materials.

|

Evidence Description |

Value |

|---|---|

|

Graphene Batteries Improve Charge Cycles |

3x |

|

Cobalt-Free Batteries Cost Reduction |

30% |

|

Battery Energy Density Increase |

250 Wh/kg (2020) to 500 Wh/kg (2030) |

|

Wireless Charging Market Growth |

$30 Billion by 2030, 25% CAGR |

The rise of wireless charging technology also reflects the industry’s focus on convenience and sustainability. The wireless charging market is expected to grow to $30 billion by 2030, with a CAGR of 25%. This growth aligns with consumer demand for clutter-free solutions and energy-efficient devices. Additionally, battery swapping systems, projected to reach $25 billion by 2030, offer a sustainable alternative for EVs, reducing downtime and promoting circular economies.

Tip: As battery prices drop from $140/kWh in 2020 to an estimated $60/kWh by 2030, consumer electronics will become more affordable and accessible, driving further adoption.

These advancements highlight the industry’s commitment to innovation and sustainability. By improving energy efficiency and reducing costs, battery technology is paving the way for a more connected and eco-friendly future.

The consumer electronics market continues to evolve, driven by rapid advancements in technology and shifting consumer preferences. Trends such as sustainability, personalization, and the growth of eCommerce are reshaping the industry. Smartphones, wearable devices, and smart home gadgets remain dominant product categories, with brands like Apple, Samsung, and Sony leading innovation. Emerging technologies, including AI, IoT, and 5G, present both opportunities and challenges. Staying informed about these developments is essential for businesses and consumers to adapt and thrive in this dynamic landscape.

What are the key trends shaping the consumer electronics market?

The market is shaped by sustainability, personalization, and eCommerce growth. Emerging technologies like AI, IoT, and 5G also play a significant role. These trends drive innovation and influence consumer preferences, creating opportunities for brands to adapt and thrive.

Which product categories dominate the consumer electronics industry?

Smartphones, wearable devices, and smart home gadgets lead the market. Other significant categories include gaming consoles, laptops, and audio-visual equipment. These products cater to diverse consumer needs, from communication to entertainment and productivity.

How do leading brands maintain their competitive edge?

Brands like Apple and Samsung focus on innovation, ecosystem integration, and customer loyalty. They invest in research and development to create cutting-edge products. Additionally, they adapt to market trends, ensuring their offerings align with consumer expectations.

What role does 5G play in consumer electronics?

5G enhances device connectivity, enabling faster data transfer and low latency. It supports applications like streaming, gaming, and IoT devices. This technology improves user experiences and drives the adoption of smart gadgets, reshaping the industry.

How is sustainability influencing consumer electronics?

Sustainability drives eco-friendly innovations and energy-efficient designs. Consumers prefer products with longer lifespans and lower environmental impact. Legislation and consumer demand encourage brands to adopt sustainable practices, making it a key market driver.

Tip: Stay updated on market trends and technologies to make informed decisions about consumer electronics purchases.

See Also

Ensuring Quality in Electronics Through Advancing Technology

Improving Smartphone Screens with MAX8647ETE+T Technology

Unveiling Essential Automotive Features of FREESCALE MCF5251CVM140

Analyzing MC9S12DJ256MFUE Specs for Automotive Use Cases

Three Key Innovations of XCF01SVOG20C in Industrial Automation