Comprehensive Analysis of Passive Electronic Components Market Trends

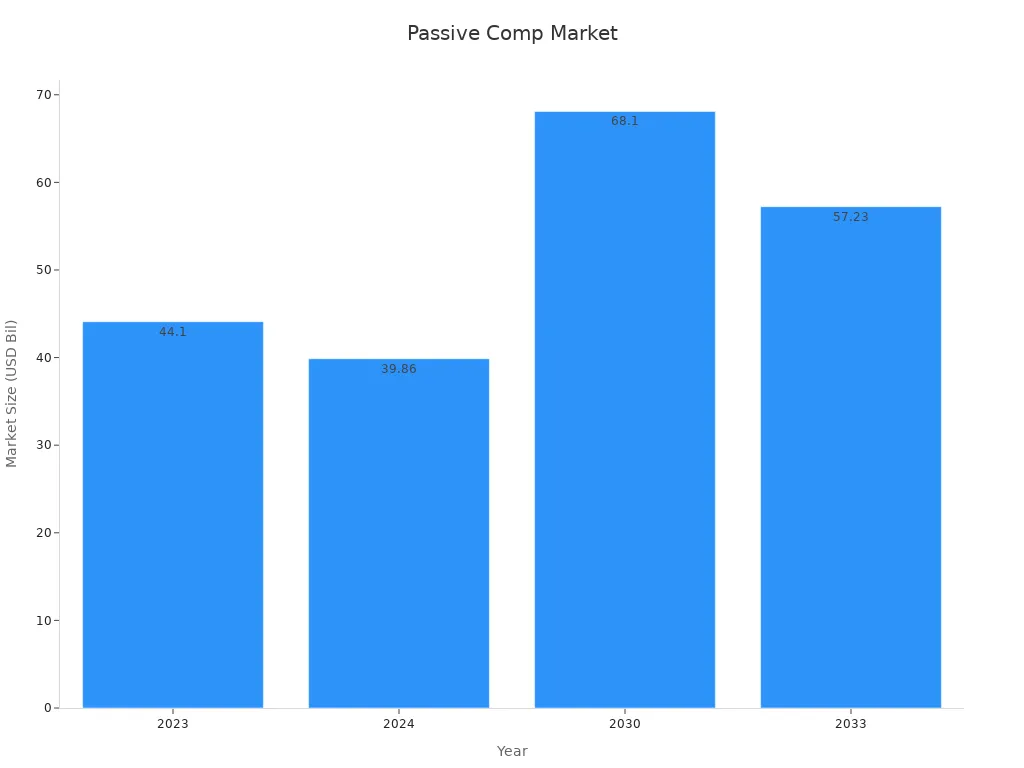

Understanding trends in the passive electronic components market holds vital importance for industries worldwide. These components, essential for electronics, play a pivotal role in shaping technological advancements. In 2023, the global market for passive electronic components generated revenue of USD 44.1 billion. Projections indicate a growth at a CAGR of 6.5%, reaching USD 68.1 billion by 2030. This growth stems from rising demand in consumer electronics and electric vehicles. For stakeholders, these trends signify opportunities to innovate and meet the evolving needs of a keepbooming supply Passive electronic components market.

Key Takeaways

The market for passive electronic parts may grow from $44.1 billion in 2023 to $68.1 billion by 2030. This is because of more use in gadgets and electric cars.

Capacitors are the most important because they store energy and help signals work, especially in 5G and electric cars.

New technology, like making parts smaller and using better materials, helps these parts work better and last longer.

Growing markets, mainly in Asia, have big chances for growth. This is due to more electric cars and 5G networks being built.

Companies need to handle problems like changing material costs and rules to stay successful in this changing market.

Overview of the Passive Electronic Components Market

Main Passive Component Categories They Supply

Capacitors: Ceramic (MLCC), film, aluminum electrolytic, tantalum, polymer

Resistors: Thick film, thin film, precision, shunt/current-sense, power

Inductors: Power inductors, RF chokes, common-mode chokes

Transformers: Power, signal, data line

Filters & Suppressors: EMI/EMC filters, ferrite beads, ESD protection

Protection Devices: TVS diodes, varistors, fuses

Market Size and Growth Forecast

The passive electronic components market is experiencing significant growth, driven by advancements in technology and increasing demand across various industries. Projections indicate that the market will expand from USD 0.76 trillion in 2025 to USD 1.16 trillion by 2030, reflecting a compound annual growth rate (CAGR) of 8.79%. This growth highlights the rising importance of passive components in modern electronics, particularly in consumer electronics and automotive sectors.

The table below provides a detailed market size and growth forecast for the coming years:

Year | Market Size (USD Billion) | Growth Rate (%) |

|---|---|---|

2023 | 44.1 | N/A |

2024 | 46.7 | N/A |

2030 | 68.1 | 6.5 |

2033 | 57.23 | 3.90 |

Key Players in the Market

The passive electronic component market features several prominent manufacturers that supply essential components like capacitors, resistors, and inductors. These companies cater to industries such as automotive, telecommunications, and consumer electronics. Below is a list of major global manufacturers:

Manufacturer | Country | Specialties |

|---|---|---|

Murata Manufacturing | Japan | MLCCs, inductors, EMI filters, RF modules |

TDK / EPCOS | Japan/Germany | Film capacitors, inductors, EMC filters |

Yageo Group | Taiwan/USA | Resistors, MLCCs, inductors, power transformers |

Vishay Intertechnology | USA | Resistors, capacitors, RF components |

Panasonic Electronic Components | Japan | Electrolytic capacitors, resistors, inductors |

These companies play a critical role in meeting the growing demand for passive components across various applications.

Industries Driving Market Growth

Several industries contribute to the rapid growth of the passive electronic components market. The consumer electronics industry remains a key driver, with increasing demand for smartphones, laptops, and wearable devices. The automotive sector also plays a significant role, particularly with the rise of electric vehicles (EVs) that require advanced passive components for power management and energy storage.

Other industries, such as telecommunications and renewable energy, further fuel market growth. The deployment of 5G infrastructure and the adoption of solar and wind energy systems create additional opportunities for passive component manufacturers. These industries rely on components like capacitors and inductors to enhance efficiency and performance.

Trends and Drivers in the Passive Electronic Components Market

Technological Advancements in Components

Technological advancements are reshaping the passive electronic components market. Innovations in materials and manufacturing processes have enabled the production of smaller, more efficient components. For instance, the introduction of graphene as a material offers enhanced conductivity and durability, paving the way for future growth opportunities. Miniaturization has become a critical trend, especially in consumer electronics, where compact devices like smartphones and wearables demand high-performance components in limited spaces.

The healthcare sector also benefits from these advancements. Miniaturized components are essential for medical devices, ensuring precision and reliability. Similarly, electric vehicles (EVs) rely on advanced capacitors and inductors to optimize power systems. The table below highlights the impact of technological advancements across various sectors:

Sector | Impact on Passive Components |

|---|---|

Healthcare | Demand for miniaturized, high-performance components for devices. |

Electric Vehicles (EV) | Essential for efficient operation of power systems. |

Consumer Electronics | Increased need for compact and reliable components. |

These advancements not only improve the performance of passive components but also expand their applications across diverse industries.

Demand from Consumer Electronics

The rising demand for consumer electronics remains a significant driver of the passive electronic components market. This segment is expected to account for approximately 38% of the total market share in 2024. The proliferation of smartphones, tablets, and smart appliances has fueled the need for components like capacitors, resistors, and inductors. Additionally, the expansion of IoT devices and smart home applications has created new opportunities for manufacturers.

The increasing adoption of 5G technology further accelerates this trend. 5G smartphones require higher component densities to support faster data speeds and improved connectivity. Rapid digitalization and population growth also contribute to the demand for passive components in devices such as laptops and home appliances. Key trends driving this growth include:

The rise of 5G smartphones and IoT devices.

Expansion of smart home applications.

Increasing demand for energy-efficient devices.

Growing reliance on passive components in healthcare electronics.

These factors underscore the importance of passive components in modern electronics, making them indispensable for technological progress.

Electric Vehicles and Market Growth

The automotive industry's shift toward electric vehicles has significantly impacted the passive electronic components market. EVs require specialized components to manage power systems, energy storage, and electronic control units. Capacitors play a crucial role in ensuring the efficient operation of these systems, while inductors and resistors support energy management and signal processing.

The growing popularity of EVs has created new opportunities for the market. Advanced driver assistance systems (ADAS) and infotainment systems in vehicles rely heavily on passive components. The table below illustrates the impact of EVs on market growth:

Evidence Description | Impact on Market Growth |

|---|---|

The automotive industry is experiencing a rising demand for electronic vehicle systems. | This demand drives the need for passive components like capacitors, which are essential for performance. |

The transition towards electric and hybrid vehicles is creating new opportunities. | Specialized electronic components are required for EVs, enhancing the market for passive components. |

The growing popularity of electric vehicles necessitates more passive components. | This trend is a major driver for the automotive passive electronic component market. |

The electrification of vehicles, combined with advancements in battery technology, ensures sustained growth for the passive electronic components market. As EV adoption increases globally, manufacturers must innovate to meet the rising demand for high-quality components.

5G Infrastructure and Its Impact

The rollout of 5G infrastructure has created a significant impact on the passive electronic components market. This next-generation network technology demands advanced components to support its high-speed data transmission and low-latency requirements. Passive components such as capacitors, resistors, and inductors play a crucial role in enabling the functionality of 5G base stations, antennas, and user devices.

5G networks require a dense deployment of base stations and small cells to ensure seamless connectivity. Each of these installations relies on passive components for power management, signal filtering, and impedance matching. The increased complexity of 5G systems has driven the demand for high-performance components that can operate efficiently at higher frequencies.

📈 Did You Know?

By 2025, 5G networks are projected to cover more than 50% of the global population, with fiber-optic deployments growing at an annual rate of over 13%.

The table below highlights key numerical evidence related to the growth of 5G infrastructure:

Evidence Description | Value |

|---|---|

Expected annual growth rate of global fiber-optic deployments | Over 13% |

Projected coverage of 5G networks by 2025 | More than 50% of global population |

The rapid expansion of 5G infrastructure has also spurred innovation in materials and designs for passive components. Manufacturers are developing components with higher thermal stability and lower energy losses to meet the stringent requirements of 5G systems. For instance, multi-layer ceramic capacitors (MLCCs) with enhanced capacitance and miniaturized inductors are becoming essential in 5G applications.

Consumer devices such as smartphones and IoT gadgets also benefit from 5G technology. These devices require compact and efficient passive components to handle the increased data speeds and connectivity demands. The integration of 5G technology into smart cities, autonomous vehicles, and industrial automation further amplifies the need for advanced passive components.

The development of 5G infrastructure represents a transformative phase for the passive electronic components market. As network providers and device manufacturers continue to adopt 5G technology, the demand for innovative and high-quality components will remain strong. This trend underscores the critical role of passive components in shaping the future of global connectivity.

Challenges in the Passive Electronic Components Market

Raw Material Cost Fluctuations

Raw material cost fluctuations pose a significant challenge to the passive electronic components market. Materials like palladium, aluminum, and copper are essential for manufacturing components such as capacitors and resistors. However, their prices often experience volatility due to geopolitical tensions, supply disruptions, and market demand. For instance, the price of palladium surged by over 90% between 2019 and 2021, leading to increased production costs for manufacturers. Similarly, aluminum prices rose from USD 2,182.4 to USD 2,192.8 per metric ton in January 2024, further escalating costs for components utilizing this material.

Raw materials account for 40% to 50% of the total cost structure in this market. Any fluctuation directly impacts the profit margins of manufacturers, forcing them to adjust pricing strategies. This instability can deter smaller players from entering the market, reducing competition and innovation. The table below highlights the impact of raw material cost fluctuations:

Evidence Description | Impact on Market |

|---|---|

Price of palladium increased by over 90% (2019–2021) | Escalated production costs, leading to pricing instability |

Raw materials constitute 40%–50% of total cost structure | Fluctuations negatively impact manufacturers' profit margins |

Aluminum price increased (Jan 2024) | Rising costs for components utilizing aluminum |

In North America, military and aerospace standards further complicate the situation. These industries require rigorous qualification processes for components like multilayer ceramic capacitors. Such processes delay product development, creating additional challenges for manufacturers in a price-sensitive market.

Supply Chain and Market Concentration

The supply chain for passive electronic components faces challenges due to market concentration and global dependencies. A few key players dominate the production of essential components, creating vulnerabilities in the supply chain. For example, countries like Japan, Taiwan, and China account for a significant share of global production. Any disruption in these regions, such as natural disasters or geopolitical conflicts, can lead to supply shortages and increased lead times.

The COVID-19 pandemic highlighted these vulnerabilities. Lockdowns and restrictions disrupted manufacturing and logistics, causing delays in component deliveries. This situation forced manufacturers to reassess their supply chain strategies, emphasizing the need for diversification and localized production. However, achieving this diversification requires substantial investment, which may not be feasible for smaller companies.

Market concentration also impacts pricing dynamics. Dominant players can influence prices, making it difficult for smaller manufacturers to compete. This concentration limits the availability of affordable components, affecting industries like consumer electronics and automotive that rely heavily on these products.

Regulatory and Environmental Challenges

Regulatory and environmental challenges significantly influence the passive electronic components market. Governments worldwide have implemented stringent regulations to ensure the safety, reliability, and environmental sustainability of electronic components. For instance, the European Union's Restriction of Hazardous Substances (RoHS) directive limits the use of hazardous materials like lead and mercury in electronics. Compliance with such regulations requires manufacturers to invest in research and development, increasing production costs.

Environmental concerns also drive the need for sustainable manufacturing practices. The production of components like capacitors and resistors often involves energy-intensive processes and generates waste. Manufacturers must adopt eco-friendly practices to reduce their carbon footprint, which can be costly and time-consuming.

The report on high-reliability passive electronic components highlights several key regulatory factors shaping the market:

Regulations and standards dictate the design and production of components, particularly in industries like aerospace and defense.

Recent regulatory changes have altered market dynamics, requiring manufacturers to adapt their strategies.

Compliance with these regulations ensures legal and operational integrity, but it also increases costs and complexity.

These challenges underscore the importance of innovation and adaptability in the passive electronic components market. Manufacturers must balance regulatory compliance with cost efficiency to remain competitive while addressing environmental concerns.

Insights by Type, Material, and Application

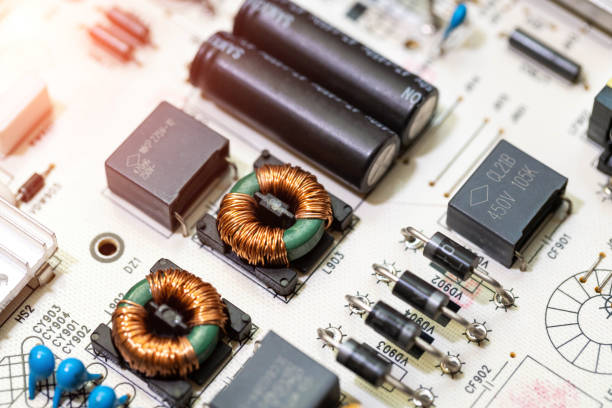

Capacitors and Their Market Dominance

Capacitors hold a dominant position in the passive electronic components market due to their versatility and widespread applications. These components are essential for energy storage, signal processing, and voltage regulation in various industries. Multilayer ceramic capacitors (MLCCs) and tantalum capacitors are particularly significant, as they support high-frequency filtering and power management in modern electronics.

The global market for capacitors is projected to grow steadily between 2025 and 2030. This growth is driven by increasing demand in sectors such as 5G communications, electric vehicles, and IoT devices. Capacitors are expected to remain the largest segment in the passive components market during this period. Their ability to filter high-frequency signals and stabilize voltage makes them indispensable in consumer electronics, automotive systems, and telecommunications.

📊 Key Insights:

Capacitors account for a significant share of the market due to their reliability, low cost, and functionality. Their dominance is further fueled by advancements in energy-efficient technologies and the proliferation of smart devices.

Resistors and Inductors in Market Growth

Resistors and inductors also contribute significantly to the growth of the passive electronic components market. Resistors play a crucial role in current limiting, voltage division, and energy dissipation. They are widely used in automotive electronics, where they manage voltage spikes and ensure system stability. Inductors, on the other hand, are vital in RF circuits and power management applications. They are commonly found in telecommunications equipment and consumer electronics like smartphones.

The table below highlights the market share growth rates of resistors and inductors:

Component Type | Market Share Growth Rate (CAGR) | Description |

|---|---|---|

Inductors | 5% | Driven by advancements in consumer electronics, particularly smartphones. |

Resistors | 3.2% | Essential for managing voltage spikes in devices like computers and phones. |

These components continue to gain traction due to their reliability and adaptability across various applications.

Material Innovations in Passive Components

Material innovations are transforming the passive electronic components market. Manufacturers are adopting advanced materials to enhance performance, reduce costs, and improve sustainability. For instance, Coilcraft's XEL40xx Series of power inductors offers ultra-low AC losses, making them ideal for high-frequency applications. Similarly, Illinois Capacitor's RJD Series utilizes encapsulated lithium-ion technology, providing higher energy storage and efficiency.

Recent advancements in 3D printing technologies have also revolutionized the production of passive components. This approach enables faster development cycles and customization for specific applications. Additionally, Panasonic's POSCAP series replaces traditional materials with conductive polymers, reducing environmental impact and enhancing recyclability.

These innovations not only improve the functionality of passive components but also address the growing demand for eco-friendly and high-performance solutions in modern electronics.

Applications in Consumer Electronics and Automotive

Passive electronic components play a crucial role in consumer electronics and automotive industries. These components ensure the functionality, efficiency, and reliability of modern devices and vehicles. Their applications span across energy storage, signal processing, and power management, making them indispensable in these sectors.

In consumer electronics, the demand for passive components continues to grow due to the proliferation of devices like smartphones, laptops, and smart home systems. Capacitors, resistors, and inductors are essential for stabilizing voltage, filtering signals, and managing power in these devices. The consumer electronics segment is projected to represent 24.7% of the global market for passive and interconnecting electronic components in 2024. This growth reflects the increasing adoption of 5G technology, IoT devices, and energy-efficient appliances. Manufacturers must innovate to meet the rising expectations for compact and high-performance components.

The automotive industry also relies heavily on passive electronic components. Electric vehicles (EVs) and advanced driver-assistance systems (ADAS) require capacitors for energy storage and inductors for power management. Resistors play a vital role in voltage regulation and current sensing within automotive systems. By 2024, the automotive sector is expected to account for 22.9% of the global passive and interconnecting electronic components market. This growth is driven by the shift toward EVs and the integration of smart technologies in vehicles.

📊 Market Insights:

The Passive Electronic Components Market is projected to reach USD 53,181.7 million by 2033, fueled by demand from consumer electronics, automotive, and industrial automation sectors.

The synergy between these industries and passive components highlights their importance in technological advancements. As consumer electronics and automotive technologies evolve, the need for innovative and efficient components will continue to rise. These insights emphasize the critical role of passive components in shaping the future of these markets.

Regional Analysis of the Passive Electronic Components Market

North America: Technological Advancements

North America plays a pivotal role in the passive electronic components market, driven by its technological advancements. The region's focus on innovation has led to the development of smaller, more efficient electronic devices. Enhanced microchips, advanced displays, and improved connectivity are fueling the demand for smarter electronics. These advancements directly impact the need for passive components, which are essential for energy storage, signal processing, and power management.

The United States, in particular, stands out due to its high concentration of data centers. Out of 8,000 global data centers, 2,701 are located in the U.S., highlighting the region's dominance in digital infrastructure. This extensive network supports the growing demand for passive electronic components in telecommunications and cloud computing. The region's emphasis on cutting-edge technology ensures sustained growth in the market.

Asia Pacific: Market Growth Leader

Asia Pacific leads the passive electronic components market in terms of growth. Countries like China and India are experiencing rapid expansion due to the rise of the telecommunications industry. The region's increasing adoption of 5G technology and IoT devices has created a surge in demand for components like capacitors, resistors, and inductors. These components are vital for ensuring the efficiency and reliability of modern electronics.

The region's manufacturing capabilities also contribute to its market leadership. Asia Pacific serves as a global hub for electronics production, with a strong focus on cost efficiency and scalability. This advantage allows manufacturers to meet the growing demand for passive components across industries such as consumer electronics, automotive, and telecommunications. The region's dynamic growth underscores its importance in shaping the future of the passive electronic components market.

Europe: Sustainability and Innovation

Europe's passive electronic components market thrives on sustainability and innovation. The region prioritizes eco-friendly practices and compliance with stringent environmental regulations. Manufacturers invest heavily in research and development to create components that meet these standards while advancing technology. This focus on sustainability drives the development of energy-efficient and recyclable components.

The aerospace and defense sectors in Europe also play a significant role in market growth. These industries demand advanced electronic devices with miniaturized components for enhanced performance. Additionally, the region's emphasis on 5G, IoT, and electric vehicles fosters innovation in passive components. Companies that adapt to these trends and prioritize R&D are better positioned to succeed in the competitive market.

📈 Market Insights:

The passive electronic components market is projected to grow at a CAGR of 5.8% from 2023 to 2030, with revenue expected to reach USD 48.7 billion by 2030. This growth reflects the increasing demand for sustainable and innovative solutions across regions.

Emerging Markets and Opportunities

Emerging markets present significant opportunities for the passive electronic components industry. Rapid technological advancements and industrial growth in these regions are driving demand for components like capacitors, resistors, and inductors. These components are essential for powering modern technologies and ensuring their efficiency.

The global shift toward electric vehicles (EVs) has created a substantial market for passive components. EVs rely on inductors, capacitors, and resistors to manage power systems and energy storage. Countries in Asia, such as India and China, are investing heavily in EV infrastructure. This trend is expected to increase the demand for high-performance passive components in these regions.

The expansion of 5G technology also offers immense potential. Emerging markets are deploying 5G networks to improve connectivity and support digital transformation. These networks require advanced passive components to handle higher frequencies and faster data transmission. Antennas, filters, and RF components are particularly critical for 5G infrastructure. As more countries adopt 5G, the demand for these components will continue to grow.

The Internet of Things (IoT) is another area of opportunity. Smart city initiatives and IoT applications are gaining traction in emerging markets. These technologies depend on passive components for energy efficiency and signal processing. The growth of IoT devices, such as smart meters and connected appliances, is expected to drive the market further.

The table below highlights key opportunity areas in emerging markets:

Opportunity Area | Description |

|---|---|

Electric Vehicle Market | The shift towards electrification in the automotive industry is increasing the demand for passive components like inductors, capacitors, and resistors essential for EV applications. |

5G Technology Expansion | The deployment of 5G networks requires advanced passive components to support higher frequencies and increased data transmission, creating a surge in demand for antennas, filters, and RF components. |

The growth of IoT and smart city initiatives is amplifying the demand for passive components, presenting substantial growth potential in the market. |

Emerging markets are poised to play a pivotal role in the future of the passive electronic components industry. Companies that invest in these regions and adapt to their unique demands will gain a competitive edge in this rapidly evolving market.

The passive electronic components market continues to evolve, driven by technological advancements and rising demand across industries. Consumer electronics and automotive sectors lead this growth, with innovations in 5G technology and electric vehicles creating new opportunities. The market is projected to expand from USD 39.84 billion in 2024 to USD 54.98 billion by 2032, reflecting a CAGR of 4.10%. Manufacturers must prioritize adaptability and innovation to meet these demands. Emerging markets further amplify growth potential, offering opportunities for companies to develop high-performance components that support modern technologies.

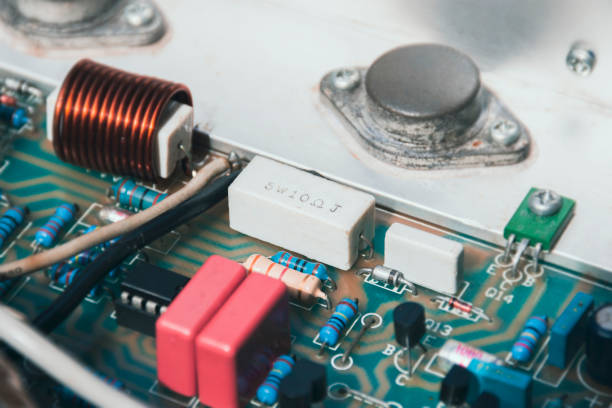

What are passive electronic components?

Passive electronic components are essential parts of electronic circuits. They do not generate energy but store, filter, or dissipate it. Examples include capacitors, resistors, and inductors. These components play a vital role in ensuring the functionality and efficiency of modern electronic devices.

Why are capacitors important in electronics?

Capacitors store electrical energy and release it when needed. They stabilize voltage, filter noise, and support power management. Their versatility makes them indispensable in devices like smartphones, electric vehicles, and 5G infrastructure.

How does 5G technology impact the passive components market?

5G technology increases demand for advanced passive components. These components, such as capacitors and inductors, support high-frequency operations and faster data speeds. The rollout of 5G networks drives innovation and growth in the passive electronic components market.

Which industries rely heavily on passive components?

Industries like consumer electronics, automotive, telecommunications, and renewable energy depend on passive components. These components ensure energy efficiency, signal processing, and power management in devices such as smartphones, electric vehicles, and solar systems.

What challenges do manufacturers face in this market?

Manufacturers face challenges like raw material cost fluctuations, supply chain disruptions, and strict environmental regulations. These factors increase production costs and require companies to innovate while maintaining compliance with global standards.

See Also

Ensuring Quality in Electronics Through Advancing Technology

Three Key Features of SPC5605BMLL6 and SPC5607BMLL6 ECUs

AD9736BBCZ: Pioneering the Next Generation of Wireless Tech

CALL US DIRECTLY

(+86)755-82724686

RM2508,BlockA,JiaheHuaqiangBuilding,ShenNanMiddleRd,Futian District,Shenzhen,518031,CN

www.keepboomingtech.com sales@keepboomingtech.com