Semiconductor distributors are undergoing profound transformations in their service models. Rapid growth in low-volume, high-mix demand, particularly by 2025, drives this market shift. Artificial intelligence (AI), electric vehicles, and advanced manufacturing fuel this demand. Traditional service models are inadequate for this new market landscape. The robust semiconductor market projects to reach $700.9 billion in 2025. Distributors implement fundamental changes across their service and manufacturing operations. They aim to thrive in this evolving market. Q4 2025 will be a crucial assessment period for these 2025 initiatives, impacting semiconductor market growth.

Key Takeaways

-

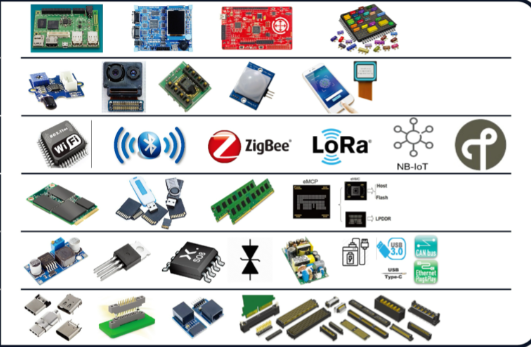

New technologies like AI and electric cars need many different kinds of computer chips, but in smaller amounts. This changes how chip companies work.

-

Chip distributors are changing how they store and move chips. They keep chips closer to customers and use technology to track them better. This helps deliver chips faster.

-

Distributors now give more help to customers. They offer expert advice early in product design and use online tools to make things easier. They also work with others to create new chip designs.

-

Companies use AI to guess what chips customers will need. They also use computers to handle orders faster. This helps them make smart choices and keep customer information safe.

-

Distributors offer new services like putting chip parts together for customers. They also help manage chip lifecycles and offer flexible prices. This helps customers make products better and faster.

The Catalyst: Semiconductor Demand Shifts

Defining Small-Batch, Multi-Variety Demand

This new market paradigm, often called small-batch, multi-variety demand, represents a significant shift away from mass production. This demand involves producing a wide array of specialized products in smaller quantities. The semiconductor industry now sees a transition from a traditional Manufacturer-to-Consumer (M2C) model to a Consumer-to-Manufacturer (C2M) model. This C2M model is driven by personalized and small-batched demand. It leads to more flexible manufacturing processes and an explosive increase in product types. Quality prediction and control become more complex than in traditional mass customization. Each operation step is influenced by numerous internal and external factors. This results in high-dimensional and complex observational data. Personalized product demand expands rapidly. This makes it difficult for quality controllers to gather sufficient samples in a single batch. They often get only limited samples for each product type. This evolving mpw service market requires new approaches. The overall semiconductor market performance depends on adapting to this demand.

Key Drivers: AI, IoT, and Niche Markets

Several powerful forces drive this shift in semiconductor demand. Artificial intelligence (AI) leads this transformation. The proliferation of AI in various sectors, from data centers to edge devices, creates a need for specialized, high-performance applications. This AI-driven market requires specific components. Electric and autonomous vehicles also demand unique semiconductor solutions. These vehicles require advanced process nodes and robust performance for their complex systems. Advanced manufacturing techniques, such as industrial IoT, further contribute to this fragmented demand. Each niche market segment requires tailored components. This contributes to the projected $700.9 billion global semiconductor sales by 2025. The mpw service market for these high-performance applications is expanding rapidly. Distributors must cater to these diverse needs. The overall market for AI applications and other specialized solutions shows strong growth. This growth impacts the entire semiconductor market. This new era of manufacturing demands agile supply chains.

Traditional Service Model Limitations

Traditional semiconductor distribution service models struggle to meet this evolving demand. These models were built for high-volume, low-mix production. They face significant limitations in the current market.

-

Shorter Lead Times: Traditional models struggle with the rapid design, build, and shipment requirements of low-volume, high-mix products. Long lead times for even a single component can significantly delay projects. This impacts market entry.

-

Component Volatility: Bills of Materials (BOMs) in low-volume, high-mix environments change constantly. Design iterations, compliance updates, or sudden shifts in component availability drive this. This demands nimble and responsive sourcing. Traditional methods often lack this capability. This affects manufacturing flexibility.

-

Supplier Fragmentation: The diverse and often small-quantity sourcing needs in low-volume, high-mix environments are difficult for conventional distribution models to manage efficiently. The fragmented nature of suppliers poses a challenge.

These limitations highlight the urgent need for distributors to transform their service models. The mpw service market demands greater agility. The semiconductor market requires new approaches to maintain performance. This impacts the overall market for specialized applications.

Inventory and Logistics Shifts

Distributors are fundamentally changing their inventory and logistics strategies. They diversify manufacturing locations. This adapts their supply chain strategies. These changes mitigate risks. They also support fragmented procurement trends. These supply chain shifts are crucial for the evolving market.

Dynamic, Decentralized Inventory Strategies

Distributors now adopt dynamic, decentralized inventory strategies. They move stock closer to customer production sites. This reduces lead times. It also enhances responsiveness to fluctuating demand. This approach helps mitigate global supply chain disruptions. It supports the fragmented procurement needs of the low-volume, high-mix market. A flexible supply chain is essential for this new service model.

Enhanced Supply Chain Visibility for Small Batches

Enhanced supply chain visibility is critical for small-batch orders. Distributors implement advanced technologies. IoT and real-time tracking tools provide live updates on product location and condition. These tools monitor sensitive cargo like semiconductors. Advanced analytics and AI-driven forecasting convert raw data into actionable insights. They predict bottlenecks and demand shifts. Integration of visibility platforms with Enterprise Resource Planning (ERP) systems ensures seamless data sharing. This fosters collaboration across the supply chain. Warehouse Management Systems (WMS) track inventory in real-time. Transportation tracking tools provide continuous visibility from entry to delivery. Custom reporting and analytics refine logistics strategy. Returns Management (RMA) services extend integration to reverse logistics. This comprehensive visibility improves service delivery.

Micro-Logistics and Last-Mile Delivery Optimization

Optimizing micro-logistics and last-mile delivery is vital. Distributors establish strategic stocking locations. These depots are close to production facilities. They meet specific service level agreements. Managing international shipments involves partnering with global freight forwarders. These partners handle time-critical freight. For domestic needs, transportation partners provide 24/7 service. This includes same-day ground or air options. Semiconductor spare parts are often ultra-sensitive. They require protection from shock and temperature changes. Special gauges monitor variances. Automated route-optimization software considers traffic and weather. It also automates driver dispatch. Centralized logistics data allows for global access and analysis. This ensures efficient service.

Consignment and Vendor-Managed Inventory (VMI)

Consignment and Vendor-Managed Inventory (VMI) models offer significant advantages. These models improve cash flow for buyers. They defer payments. They also reduce the risk of out-of-stocks. Vendors monitor and replenish inventory. This leads to better demand forecasting. It also enhances operational efficiency through automation. VMI streamlines inventory management. It transfers responsibility to suppliers. This reduces inventory carrying costs. It also ensures precise production scheduling. These models require high trust and transparency. They demand advanced IT systems for data exchange. Clear legal agreements are necessary. These models strengthen buyer-vendor relationships. They enhance the overall service offering in the market.

Customer Engagement and Technical Service

Proactive Technical Support for Design-In

Distributors now offer proactive technical support for design-in. This service helps customers early in product development. They provide expertise for complex semiconductor integrations. This includes embedding unique cryptographic keys and certificates for trusted digital identities. Distributors also integrate post-quantum security. They personalize chips with quantum-resistant certificates and keys. This customization at scale adapts security features to industry needs. Distributors operate under a Common Criteria Certified Environment (CCEAL5+). This ensures high security standards. They manage the secure supply chain. This controls the chip personalization process. It ensures end-to-end traceability. It protects against counterfeit risks. This proactive service minimizes design risks. It accelerates time-to-market for new products.

Personalized Account Management

Personalized account management is crucial. Distributors analyze a key account’s strategy and performance. This leads to actionable insights. They develop new value propositions. Distributors share strategic initiatives. This accelerates customer growth and profitability goals. Account managers map all stakeholders. They track design project timelines. They monitor competitor activity. Documenting technical requirements is essential. Quarterly business reviews with measurable KPIs are standard. Automated tracking tools provide real-time insights. Effective tracking monitors revenue metrics, engagement KPIs, and predictive scoring. Revenue metrics include Customer Lifetime Value (CLV). Engagement metrics cover usage frequency. Predictive scoring uses machine learning models. These models calculate churn risk and identify expansion opportunities. Strategic partnership analysis offers insights into market trends. This helps anticipate technology shifts. Distributors set up alerts for executive changes. They analyze LinkedIn hiring trends. They create a ‘new executive welcome’ program. Implementing predictive analytics transforms management. It moves from reactive to proactive. This involves AI-driven tools. They analyze customer behavior patterns. They forecast growth opportunities. They identify at-risk accounts.

Digital Platforms for Streamlined Access

Digital platforms streamline access to services. Distributors provide online portals. These platforms offer self-service options. Customers can access product information, order status, and technical documentation. They also manage accounts. These digital tools enhance efficiency. They improve the customer experience. This modern approach supports the fast-paced market and its evolving demands.

Collaborative Engineering and Multi-Project Wafer Support

Collaborative engineering and multi-project wafer support are vital. CMC Microsystems, a non-profit, facilitates collaborative engineering. They lower barriers to design, manufacturing, and prototyping. This includes microelectronics, photonics, quantum, MEMS, and packaging. They enable research teams and academic institutions. These teams turn designs into prototypes annually. This support fosters industrial collaborations. It trains qualified personnel for the industry. The expanding mpw service market benefits from these initiatives. Multi-project wafer (MPW) services are a form of collaborative engineering. Companies, foundries, and government institutions offer these services worldwide. They are effective for system-on-a-chip integration. They also apply to MEMS, integrated photonics, flexible electronics, microfluidics, and chiplets. The growth of the mpw service market reflects this versatility. GlobalFoundries (GF) offers the ‘GlobalShuttle’ MPW program. This program provides cost-effective semiconductor prototyping solutions. It serves new and existing customers, startups, and universities. It supports all GF technology platforms. The program increases shuttle frequency. This aligns with design cycles. It reduces minimum area requirements and MPW fees. It optimizes customer experience. It offers a revitalized education package. Incentives for transitions from MPW to production are available. Customers can double die samples, up to 100 die, as part of the base MPW fee. These customizable mpw options enhance the mpw service market. This service model supports innovation. The competitive mpw service market demands such comprehensive offerings. Distributors actively shape the future of the mpw service market. They provide essential infrastructure for the mpw service market. This ensures continued growth in the mpw service market. The demand for specialized chips drives the mpw service market. This makes the mpw service market a key area for investment. The mpw service market is crucial for rapid development.

Digital Transformation and Data Analytics

Digital transformation fundamentally reshapes how semiconductor distributors operate. This shift involves leveraging advanced technology to enhance efficiency, improve decision-making, and secure critical data. Distributors embrace these changes to meet the complex demands of the low-volume, high-mix market. This transformation drives significant innovation across their service models.

AI and Machine Learning for Demand Forecasting

Artificial intelligence (AI) and machine learning (ML) revolutionize demand forecasting. These advanced algorithms ingest diverse historical and real-time data. This data includes past orders, economic indicators, market trends, and customer inventory levels. AI and ML detect non-obvious patterns within this complex information. This capability is crucial for the volatile and complex demand of low-volume, high-mix products. For example, NXP Semiconductors significantly improved its long-range forecast accuracy. They deployed ML models, including neural networks and random forests. These models incorporated factors like distributor sell-through and macroeconomic data. NXP’s ML models outperformed legacy statistical models by over 20%. This demonstrates ML’s ability to handle complex data relevant to low-volume, high-mix scenarios. AI-driven forecasting systems continuously learn from new data. They adapt to market shifts faster than manual methods. This continuous adaptation is vital for the dynamic nature of low-volume, high-mix semiconductor products. Best practices for improving forecasting accuracy with AI include integrating diverse data sources. These sources include OEM production plans, economic indexes, and web search trends. Distributors continuously retrain models to capture new demand signals. They also maintain human oversight for qualitative adjustments and feedback loops. These practices particularly benefit managing the complexity and variability of low-volume, high-mix portfolios. This innovation in forecasting strengthens the overall service offering.

Automation of Order Processing

Automation significantly streamlines order processing. Distributors implement robotic process automation (RPA) and other digital tools. These tools handle routine tasks like order entry, validation, and fulfillment. Automation reduces manual errors and accelerates processing times. This allows distributors to manage a higher volume of small, diverse orders efficiently. Automated systems can quickly verify product availability and customer details. They also generate necessary documentation. This efficiency improves customer satisfaction and operational speed. It ensures faster turnaround times for specialized components. This enhances the overall service delivery in a competitive market.

Data-Driven Decision Making

Data-driven decision making becomes paramount for distributors. They collect and analyze vast amounts of operational and market data. This data informs strategic choices across various functions. Distributors use analytics to optimize inventory levels, set dynamic pricing strategies, and segment customers more effectively. They gain insights into purchasing behaviors and market trends. This allows them to tailor their service offerings and allocate resources more efficiently. Data analytics helps identify emerging market opportunities and potential risks. This proactive approach fosters continuous innovation and maintains a competitive edge in the market. It transforms how distributors approach every aspect of their business.

Cybersecurity and Data Integrity

Cybersecurity and data integrity are critical concerns in the digital age. Distributors handle sensitive intellectual property and customer data. Protecting this information from threats is essential. Supply chain attacks pose a significant risk. Attackers can compromise software updates or inject malicious code into vendor systems. This malicious code then spreads to manufacturers. The SolarWinds breach exemplified this danger. It showed how a compromised software update could lead to widespread disruptions and unauthorized access to sensitive systems. Insider threats also present a challenge. Employees or contractors might abuse access privileges, either intentionally or unintentionally. This can compromise data or systems.

Intellectual property theft is another major concern. Nation-state actors often carry out these attacks. They infiltrate networks to steal proprietary designs, processes, or technologies. They use phishing, exploit vulnerabilities, or target connected devices. Semiconductor manufacturers are frequent targets for advanced chip designs. For instance, at least three state-linked groups have engaged in spear-phishing campaigns targeting Taiwan’s semiconductor ecosystem. These campaigns targeted manufacturers, design firms, and logistics companies. Equipment sabotage involves attacks on industrial control systems (ICS) or operational technologies (OT). These attacks aim to disrupt production or cause physical damage. They exploit outdated systems and vulnerabilities. Nation-state attacks are sophisticated and highly targeted. They leverage advanced techniques for data theft, operational disruption, or economic advantage. Ransomware accounts for nearly half of all breaches in manufacturing. Spear-phishing is widely used to acquire credentials and distribute malware. Remote Access Trojans (RATs) and backdoors are employed for long-term espionage or disruption. Intellectual property (IP) theft, counterfeiting, and reverse engineering are significant security challenges. These threats often lead to system failures, data loss, and product unavailability. Collusion threats, where adversaries collaborate across different supply chain stages, are increasing. These threats can compromise hardware. Distributors must implement robust cybersecurity measures. This protects their data, their customers, and the integrity of the entire supply chain. This commitment to security enhances trust in their service.

New Business Models and Value-Added Services

Component Kitting and Assembly

Distributors now offer component kitting and assembly as a crucial service. This service streamlines production for customers. It consolidates components, reducing time spent gathering materials. Parts become readily available. This increases efficiency in manufacturing. Outsourcing assembly minimizes overhead costs. It saves both time and money for businesses. Distributors provide pre-packaged kits. This ensures consistency and minimizes errors. It reduces missing parts, leading to higher-quality products. This service allows companies to adjust production volumes easily. They do not need additional resources or infrastructure. This accommodates growth or fluctuations in demand. Consolidating components into a single kit accelerates the production schedule. It reduces time spent on sourcing individual parts. This minimizes procurement costs. It simplifies procurement by consolidating orders. This reduces administrative overhead. It also leverages bulk purchasing opportunities. This service enhances production efficiency. It ensures all components are ready, reducing downtime on assembly lines. This improves quality control. Pre-assembled kits undergo thorough quality checks. This minimizes defects and enhances the final product’s overall quality. This value-added service is vital for the low-volume, high-mix market.

Lifecycle Management and Obsolescence Mitigation

Distributors provide lifecycle management and obsolescence mitigation. This service helps customers navigate component changes. It addresses end-of-life issues for critical parts. They offer proactive solutions. This ensures long-term product viability. This service is essential in a rapidly evolving market. It prevents costly production delays. Distributors identify alternative components. They manage inventory transitions. This supports continuous manufacturing operations.

Flexible Pricing and Procurement

Flexible pricing and procurement models are emerging. Distributors offer adaptable pricing strategies. They meet diverse customer needs. This includes volume-based discounts for larger orders. It also includes tailored pricing for small-batch requirements. Flexible procurement options provide greater agility. Customers can choose various purchasing agreements. This optimizes their supply chain costs. This service enhances customer satisfaction. It supports varied production demands in the market.

Strategic Partnerships and Ecosystem Collaboration

Strategic partnerships and ecosystem collaboration drive innovation. Distributors form alliances with technology providers. They partner with manufacturing specialists. This expands their service offerings. They create comprehensive solutions for customers. This collaboration fosters innovation across the mpw service market. It opens new opportunities for growth. Distributors work with design houses and foundries. This ensures seamless integration of new technologies. This approach strengthens the entire supply chain. It creates a more robust market for specialized components. This collaborative service model benefits all participants. It accelerates product development. It brings new solutions to the market faster. This creates significant opportunities for future innovation.

The semiconductor distributor landscape has irrevocably changed due to LVHM demand, necessitating fundamental shifts in service models. Distributors transformed their service offerings, from agile inventory and logistics, which enhance operational efficiency and reduce lead times, to personalized customer engagement. They also leverage advanced digital capabilities and innovative business models. This comprehensive service approach drives significant growth. Agility, data intelligence, and customer-centricity are essential for survival and growth in the 2025 market. This evolution positions the semiconductor distributor for significant growth, creating a more dynamic, responsive, and value-driven service ecosystem in the semiconductor market. These 2025 initiatives redefine the service landscape for the semiconductor industry, shaping its future market service.

FAQ

What drives the shift to low-volume, high-mix demand?

AI, electric vehicles, and advanced manufacturing drive this shift. These sectors require specialized semiconductor solutions in smaller quantities. This moves away from traditional mass production models. The mpw service market greatly benefits from this trend. The mpw service market sees significant growth.

How do distributors adapt inventory strategies for LVHM?

Distributors use dynamic, decentralized inventory strategies. They position stock closer to customers. This reduces lead times and improves responsiveness. Enhanced supply chain visibility is also crucial for the mpw service market. This adaptation supports the evolving mpw service market.

What role does AI play in demand forecasting?

AI and machine learning analyze vast data sets. They predict demand for low-volume, high-mix products. This improves forecast accuracy by over 20% compared to traditional methods. This helps distributors navigate the complex mpw service market. The mpw service market demands precise forecasting.

How do distributors enhance customer engagement?

Distributors offer proactive technical support for design-in. They provide personalized account management. Digital platforms streamline access to information. Collaborative engineering and mpw service market support are also vital. This enhances the overall mpw service market experience.

Why is cybersecurity important for distributors?

Distributors handle sensitive data and intellectual property. Robust cybersecurity protects against supply chain attacks, insider threats, and IP theft. This ensures data integrity and builds trust in their service. The mpw service market relies on secure operations. This protects the entire market. The mpw service market thrives on trust.

See Also

Achieving Excellence: Innovation, Quality, and Future Trends in Electronic Components

XCF01SVOG20C: Three Key Transformations for Industrial Automation Success

Coilcraft XPL2010: High-Performance Inductors for Optimal VRM/VRD Design

NXP Microcontrollers: Powering Automotive Electronics with Core Chip Innovation

Integrating AEAT-8800-Q24: Boosting Robotics Performance Through Advanced Solutions