Semiconductor equities experienced a broad-based rally, reflecting renewed optimism in the tech sector. Companies like Nvidia and AMD led the gains, driven by their innovative semiconductor devices tailored for AI applications and gaming. The electric vehicle market’s growth and the large-scale deployment of 5G technology further fueled investor confidence. This surge highlights the critical role semiconductors play in powering advancements across industries, from autonomous driving to enhanced connectivity. As investor sentiment improves, the sector continues to attract attention for its promising growth opportunities.

Key Takeaways

-

Chip stocks are doing well because of better market feelings and new tech, especially in AI and gaming.

-

Investors need to watch inflation and GDP growth since these affect chip demand and profits.

-

Knowing global trade rules is important as they impact supply chains and market balance in the chip industry.

-

Big companies like Nvidia and AMD are growing fast with new products, so investors should keep an eye on them.

-

Even with problems like supply chain issues, the chip industry is growing with chances in AI, cars, and healthcare.

Broader Market Context

Inflation Data and Its Impact

Inflation plays a critical role in shaping investor decisions, particularly in sectors like semiconductors. Rising inflation often leads to higher production costs, which can affect profit margins for chipmakers. However, the semiconductor industry has shown resilience due to its essential role in powering technological advancements. Recent economic analysis highlights the importance of monitoring inflation indicators, such as the Consumer Price Index (CPI), to understand purchasing power and investment returns. For instance, core inflation remains a key focus for the Federal Reserve, influencing monetary policies that directly impact market conditions.

Investors also consider broader economic indicators like GDP growth when evaluating opportunities in the tech sector. A growing GDP often signals increased consumer spending, which can drive demand for semiconductors in industries like consumer electronics and automotive. On the other hand, inflationary pressures can lead to cautious spending, affecting downstream markets reliant on semiconductor components. Balancing these factors is crucial for investors aiming to navigate the complexities of the market.

Trade Developments Shaping Investor Confidence

Global trade policies significantly influence the semiconductor market, given the industry’s reliance on international supply chains. Recent trade developments, such as tariff adjustments and export restrictions, have created both challenges and opportunities for semiconductor companies. For example, policies aimed at supply chain localization, like the U.S. CHIPS Act, have bolstered investor confidence by promoting domestic manufacturing and reducing dependency on foreign suppliers.

Trade balance also plays a pivotal role in shaping exchange rates and international trade dynamics. Investors closely monitor these factors to assess the stability of supply chains and the potential for market disruptions. Additionally, geopolitical tensions can impact the availability of critical materials used in semiconductor production, further emphasizing the need for strategic planning. By understanding these trade developments, investors can make informed decisions that align with market trends.

Role of Market Sentiment in Sector Performance

Market sentiment serves as a powerful driver of performance in the semiconductor sector. Positive sentiment often leads to increased investments and higher stock valuations, reflecting optimism about future growth. Institutional investor movements, financial metrics, and sentiment analysis tools provide valuable insights into these trends. For instance, a study using Google Trends analyzed search engine data to measure investor attention toward semiconductors, offering a quantifiable perspective on market sentiment.

The semiconductor sector’s recent gains highlight the importance of aligning sentiment with tangible growth opportunities. Investors should analyze financial metrics, such as revenue growth and profit margins, to gauge the sector’s health. Additionally, potential risks like supply chain disruptions and regulatory changes must be considered to maintain a balanced outlook. By leveraging sentiment analysis alongside traditional financial measures, investors can better understand the factors driving market performance.

Key Semiconductor Stocks Driving Gains

Nvidia’s Leadership in AI and Gaming

Nvidia has emerged as a dominant force in the semiconductor industry, particularly in artificial intelligence chips and gaming. The company reported a remarkable revenue of $39.33 billion, reflecting a 78% year-over-year increase. This growth stems from its leadership in AI technologies, with data center sales rising by 93% over the same period. Nvidia’s gross margin of 71.5% highlights its operational efficiency and strong demand for high-margin products.

The company’s advancements in artificial intelligence chips have revolutionized industries. Its GPUs power AI workloads, enabling breakthroughs in machine learning and data processing. Nvidia’s record-breaking cash flow of $28.09 billion in FY24 further underscores its financial strength. These achievements position Nvidia as a leader in both innovation and profitability, driving significant gains in semiconductor stocks.

AMD’s Competitive Edge in Processors

AMD continues to challenge its competitors with cutting-edge processors and robust market performance. The company achieved Q3 revenue of $6.8 billion, an 18% year-over-year increase. Its data center segment contributed $3.5 billion, showcasing a 122% surge driven by demand for AI-focused products. AMD’s Instinct MI325X chip exemplifies its innovation, offering 40% more inference performance on specific AI models compared to Nvidia’s H200.

This focus on high-performance processors has strengthened AMD’s position in the semiconductor market. Its ability to deliver advanced chips for AI and data centers has attracted significant investor interest. AMD’s consistent growth and technological advancements highlight its competitive edge, making it a key player in driving gains across semiconductor stocks.

Broadcom’s Strategic Growth Initiatives

Broadcom’s strategic initiatives have propelled its growth in the semiconductor sector. The company reported revenue growth from $20 billion in FY18 to $34.3 billion in FY23. Its AI semiconductor revenue increased by 150% year-over-year, reaching $3.7 billion. This shift toward AI-driven products has offset challenges in other segments, showcasing Broadcom’s adaptability.

Operational efficiency remains a cornerstone of Broadcom’s success. The asset turnover ratio improved from 0.33 in FY20 to 0.49 in FY23, reflecting enhanced revenue generation. Additionally, Broadcom’s focus on cost management has led to consistent improvements in operating income and profit margins. These strategic moves have solidified Broadcom’s position as a leader in the semiconductor industry, contributing to the sector’s overall gains.

Sector-Wide Trends in Semiconductors

Comparison with Other Market Sectors

Semiconductors have consistently outperformed many other market sectors due to their critical role in technological innovation. A comparative analysis of key financial indicators highlights this trend. For instance, ON Semiconductor’s Price to Earnings (PE) ratio stands at 16.19, which is 0.26x less than the industry average. Similarly, its Price to Book (PB) ratio is 3.65, falling 0.4x below the average. Despite these metrics, ON Semiconductor demonstrates stronger debt-to-equity ratios compared to peers, showcasing financial stability.

|

Indicator |

ON Semiconductor |

Industry Average |

Comparison |

|---|---|---|---|

|

Price to Earnings (PE) |

16.19 |

Average |

0.26x less than average |

|

Price to Book (PB) |

3.65 |

Average |

0.4x below average |

|

Price to Sales (PS) |

4.01 |

Average |

0.37x below average |

|

Return on Equity (ROE) |

4.11% |

Average |

0.33% below average |

|

EBITDA |

$580 Million |

Average |

0.13x below average |

|

Revenue Growth Rate |

-17.15% |

13.95% |

Below average |

|

Debt-to-Equity Ratio |

0.4 |

Peers |

Stronger than peers |

This comparison underscores the semiconductor sector’s resilience, even when facing challenges like fluctuating revenue growth rates.

Technological Innovations Boosting Growth

Technological advancements continue to drive growth in the semiconductor industry. The IEEE 2024 Technology Megatrends report emphasizes the importance of digital transformation and sustainability. Artificial General Intelligence (AGI) has emerged as a key driver, reshaping semiconductor applications across industries. Companies are adopting challenge-driven operational models to address specific innovation needs. Investments in next-generation infrastructure, such as Amkor’s new facility in Arizona, enhance research and development capabilities while strengthening domestic supply chains.

-

Key innovations include:

-

Enhancements in advanced facilities to improve learning cycles.

-

Cost-effective business models ensuring infrastructure sustainability.

-

Significant economic impacts on government, industry, and academia.

-

These initiatives position semiconductors as a cornerstone of technological progress.

Supply Chain Challenges and Opportunities

Supply chain dynamics present both challenges and opportunities for semiconductor production. Companies face risks due to reliance on limited materials and concentrated suppliers in East Asia. Diversifying suppliers and exploring alternative input materials can mitigate disruptions and price volatility. Regulatory intelligence also plays a crucial role in maintaining compliance and avoiding operational interruptions.

-

Strategies to address supply chain challenges:

-

Proactively diversifying sourcing to reduce dependency on specific regions.

-

Leveraging innovative resources to sustain production.

-

Staying updated on evolving regulations to ensure smooth operations.

-

By addressing these challenges, the semiconductor industry can unlock new opportunities for growth and resilience.

Future Outlook for Semiconductor Equities

Risks in the Semiconductor Market

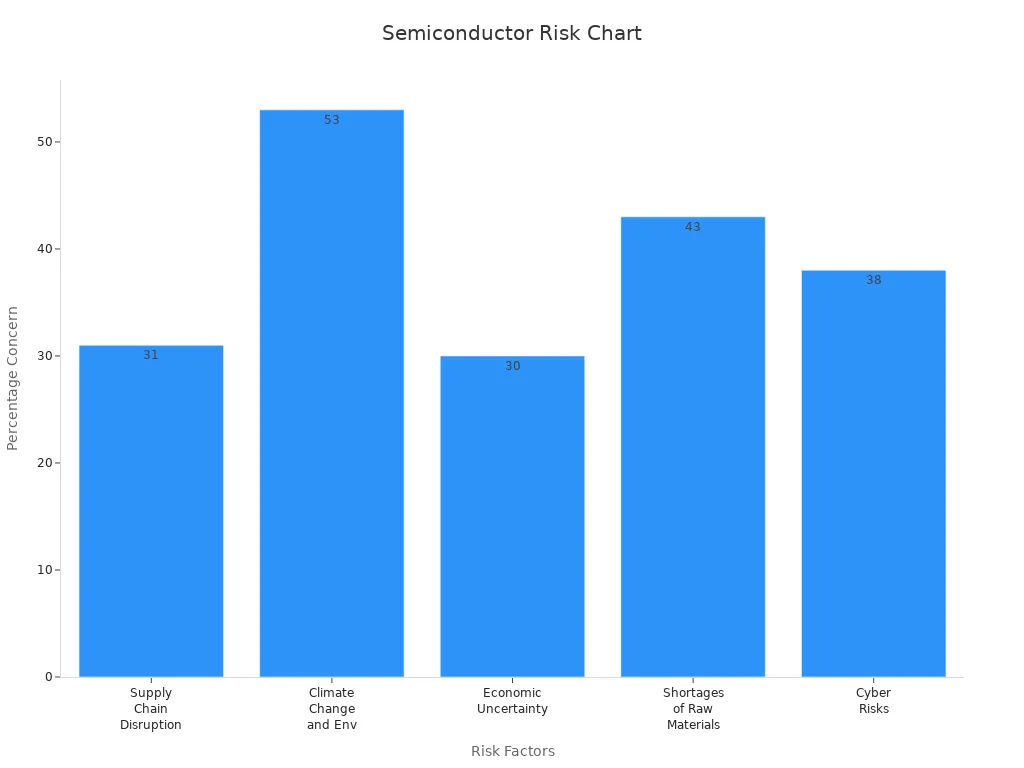

The semiconductor industry faces several risks that could impact its growth trajectory. Supply chain disruptions remain a significant concern, with 31% of industry stakeholders identifying it as a critical challenge. These disruptions often stem from geopolitical tensions, natural disasters, or reliance on concentrated suppliers in specific regions. For example, East Asia dominates semiconductor manufacturing, making the industry vulnerable to regional instability.

Environmental factors also pose a growing threat. Climate change and environmental concerns were cited by 53% of respondents in a recent survey, highlighting the industry’s dependence on energy-intensive manufacturing processes. Additionally, shortages of raw materials, such as rare earth metals, create bottlenecks in production. These shortages, identified by 43% of respondents, can lead to increased costs and delays in chip manufacturing.

Economic uncertainty further complicates the landscape. Fluctuating demand for consumer electronics and automotive products, coupled with high inventory levels, has created volatility in the market. For instance, memory sales are forecasted to recover in 2024 after a sharp decline of 31% in 2023. However, fab utilization rates remain below 70%, indicating underused production capacity.

|

Risk Factor |

Percentage of Concern |

|---|---|

|

Supply Chain Disruption |

31% |

|

Climate Change and Environmental |

53% |

|

Economic Uncertainty |

30% |

|

Shortages of Raw Materials |

43% |

|

Cyber Risks |

38% (high impact) |

To mitigate these risks, companies are diversifying supply chains, investing in sustainable practices, and adopting advanced risk management strategies.

Opportunities for Expansion and Innovation

Despite the challenges, the semiconductor industry is poised for significant growth, driven by advancements in technology and increasing demand across various sectors. The market is expected to grow by 9.5% in FY25, with strong performance anticipated in AI and data center segments. Innovations in manufacturing processes, such as advanced packaging and new materials, are essential for meeting the demands of emerging applications.

Key opportunities include:

-

AI and Data Centers: The rising adoption of AI technologies and cloud computing has created a surge in demand for high-performance chips. Companies are investing heavily in R&D to develop processors capable of handling complex workloads.

-

Automotive and Consumer Electronics: The automotive semiconductor market is projected to surpass $100 billion by 2029, driven by electric vehicles and advanced driver assistance systems. Similarly, consumer electronics continue to be a major growth driver, with smartphone and PC sales expected to recover by 4% in 2024.

-

Medical and Cryogenic Applications: New applications in medical electronics and cryogenic technology are emerging, offering untapped potential for innovation and revenue generation.

-

The semiconductor industry is projected to reach approximately $697 billion by 2025, an 11% year-over-year increase.

-

Companies are expected to invest around $185 billion in capital expenditures to expand manufacturing capacity by 7%.

-

The shift from a seller’s market to a buyer’s market suggests increased competition and innovation opportunities.

These developments underscore the industry’s ability to adapt and thrive in a rapidly changing environment.

Long-term Trends Shaping the Industry

Several long-term trends are shaping the future of the semiconductor industry. AI continues to be a major driver, with capital expenditures for AI infrastructure expected to exceed $300 billion by 2025. This investment reflects the growing importance of semiconductors in powering AI applications across industries.

Advanced packaging solutions, such as chiplets and 3D stacking, are becoming essential as traditional transistor scaling slows down. These innovations enable higher performance and energy efficiency, addressing the limitations of current manufacturing technologies.

The automotive sector also represents a significant growth area. By 2029, the semiconductor content in electric vehicles and advanced driver assistance systems is expected to drive the automotive semiconductor market to over $100 billion. This trend highlights the increasing integration of semiconductors in everyday technologies.

Other notable trends include:

-

Geopolitical Shifts: Countries like China are ramping up investments in semiconductor manufacturing, reshaping global supply chains. Government incentives, totaling around $200 billion across major economies, are further influencing the industry’s landscape.

-

Data Storage and Processing: The demand for data storage and processing power is experiencing a long-term shift, driven by sectors such as AI, consumer electronics, and autonomous vehicles.

-

Sustainability: As environmental concerns grow, the industry is focusing on reducing its carbon footprint through energy-efficient manufacturing processes and sustainable materials.

“By enhancing the timeliness of risk assessments and delving into the influence of non-traditional factors such as market sentiment and investor behavior, the semiconductor industry can develop a more holistic and dynamic risk assessment model.”

These trends indicate a promising future for the semiconductor industry, provided it can navigate the associated risks and capitalize on emerging opportunities.

Semiconductor equities have demonstrated remarkable resilience and growth, driven by improved market sentiment and technological advancements. The PHLX Semiconductor Sector index highlights this trend, showing significant fluctuations that align with rising investor attention and sentiment scores. Studies confirm a strong correlation between sentiment analysis and stock performance, emphasizing the role of optimism in driving gains.

The industry’s future depends on balancing risks like supply chain disruptions with opportunities for innovation in AI, automotive, and medical applications. Strategic investments in advanced manufacturing and sustainable practices will shape the trajectory of semiconductor equities, ensuring continued growth and adaptability in a dynamic market.

What drives the growth of semiconductor equities?

Semiconductor equities grow due to advancements in AI, automotive, and 5G technologies. Increased demand for high-performance chips and innovations in manufacturing processes also contribute. Positive market sentiment and government incentives further boost investor confidence in the sector.

How do rising semiconductor stock prices impact R&D?

Higher stock prices increase market capitalization, enabling companies to raise capital for research and development. This funding supports innovation in chip architectures, advanced manufacturing processes, and emerging applications like AI and autonomous vehicles.

What challenges does the semiconductor industry face?

The industry faces supply chain disruptions, environmental concerns, and raw material shortages. Geopolitical tensions and economic uncertainty also pose risks. Companies address these challenges by diversifying suppliers, adopting sustainable practices, and investing in risk management strategies.

How does the semiconductor sector influence global trade?

The semiconductor sector strengthens the economic position of leading nations like the U.S., South Korea, and Taiwan. Government incentives, such as the CHIPS Act, promote domestic manufacturing and supply chain localization, enhancing resilience and competitiveness.

What are the long-term trends shaping the semiconductor industry?

AI adoption, advanced packaging solutions, and automotive applications drive long-term growth. Sustainability initiatives and geopolitical shifts also influence the industry’s trajectory. Investments in manufacturing capacity and innovation ensure adaptability in a dynamic market.

See Also

Ensuring Quality in Electronics Through Advancing Technology

Three Key Features of SPC5605BMLL6 and SPC5607BMLL6 ECUs

Enhancing Automotive Performance Using NXP Microcontrollers MC9S12 Series

Simple Engine Control Solutions with SPC56 Microcontrollers

IRF820: A Versatile N-Channel MOSFET for Power Applications