The U.S. automotive tariff policy imposes a 25% tax on imports, leading to significant challenges for global car supply chains. The cost of manufacturing cars has surged, increasing by $3,500 to $12,000 per vehicle. As a result, imported cars are now priced up to $12,500 higher. This tariff policy alters trade regulations, forcing companies to adjust their strategies. The repercussions extend beyond the automotive sector, negatively impacting the economy and international trade. Experts predict that car imports will decline by 74%, highlighting the severity of the situation.

Key Takeaways

-

The U.S. 25% tax on car imports makes new cars cost more. This makes it harder for people to buy them.

-

Car makers now spend more to build cars because of the tax. This means fewer cars are imported, and some workers might lose jobs.

-

Moving factories to the U.S. is hard for companies. It costs a lot, and the government doesn’t help much like in China.

-

More people are buying used cars since new ones are too expensive.

-

Countries are fighting over trade. Other nations added their own taxes, hurting global trade and the economy.

Disruptions to Global Supply Chains

Impact on Automotive Production and Costs

The U.S. tariffs have caused big problems for car supply chains. Car parts often cross borders many times before being put together. For example, a transmission might travel between the U.S., Canada, and Mexico several times. Each crossing adds costs because of the tariffs, making cars more expensive to build. Over half of the parts in “American” cars now come from other countries, making costs harder to manage.

European carmakers are losing billions of dollars due to these tariffs. A German car sold in the U.S. could cost $10,000 more, making it harder to sell. North America makes about 63,900 cars each day: 41,700 in the U.S., 17,600 in Mexico, and 4,600 in Canada. Tariffs could cut daily production by over 20,000 cars, showing how much they hurt profits and production.

Challenges in Relocating Manufacturing to the U.S.

Moving factories to the U.S. is not easy for car companies. While it sounds like a good idea, it often costs too much. Many companies move to places like Mexico or Vietnam, where making cars is cheaper. The trade fight between the U.S. and China has made this even harder. Instead of helping U.S. factories, it has helped factories in other countries.

The U.S. does not have policies to help factories like China does. China gives money to support its factories, but the U.S. does not. Without this help, companies find it risky to move production to the U.S. Studies show that U.S. tariffs on China have made factories in Mexico and Vietnam busier, showing how tricky it is to change supply chains.

Discouragement of Long-Term Investments

Tariffs have made car companies unsure about spending money on big projects. They don’t want to take risks because trade rules keep changing. This hurts production and makes investors less confident. Trade fights have made markets unstable, cutting company profits and making long-term plans less appealing.

Canada, an important part of the North American car industry, is also struggling. Tariffs have slowed production and raised prices, making things harder for the industry. Companies now see the need to spread out their supply chains to avoid risks. But doing this takes time and money, adding more challenges to an already tough situation.

Implications for the Semiconductor Industry

Rising Costs of Semiconductor Components

The cost of semiconductor parts is a big problem for carmakers. The global semiconductor market might grow from $631.30 billion in 2023 to $1.013 trillion by 2030. This growth happens because of better technology that saves energy and works faster. But, making these advanced chips costs more due to their complex designs. Smaller chip sizes and better features take longer to develop, which raises costs.

Problems in the supply chain make things worse. Natural disasters and political issues often stop the flow of important parts. These problems cause delays and make production more expensive. As chips get more advanced, keeping a steady supply becomes harder. This affects both carmakers and tech companies.

Increased Semiconductor Content in U.S. Vehicles

Cars in the U.S. now use more semiconductors than before. New cars need chips for safety systems, entertainment, and electric engines. Electric cars, especially, need many more chips than gas-powered cars. This means semiconductors are very important for making modern cars.

Car companies in the U.S. are focusing on using better chips to meet customer needs. But, the high cost of these parts makes it hard to keep prices low. This shows how semiconductors are shaping the future of cars.

Barriers to Domestic Semiconductor Production

Making semiconductors in the U.S. has many challenges. Building factories costs a lot of money, making it hard to start. Companies also have to follow strict rules, which adds more work. There aren’t enough skilled workers to meet the demand, making it even tougher.

|

Barrier |

Description |

|---|---|

|

High Capital Investments |

Starting a factory costs a lot of money. |

|

Regulatory Requirements |

Companies must follow strict rules to produce chips. |

|

Labor Shortages |

Not enough skilled workers to make semiconductors. |

Other industries also need skilled workers, making the shortage worse. This problem affects not just chip-making but also the U.S. economy. Fixing these issues is key to making more chips in the U.S. and relying less on other countries.

Higher Prices and Consumer Impacts

Price Increases for Domestic and Imported Cars

The 25% tariffs on imports have made cars cost more. Both U.S.-made and imported cars now have higher prices. Tariffs on goods from Canada, Mexico, and China in 2025 disrupted supply chains. This raised the cost of car parts, making production more expensive. Car makers had to pass these extra costs to buyers.

-

A three-year-old car now costs $5,000 to $7,500 more.

-

Imported cars are even pricier, making them harder to sell in the U.S.

These changes affect not just car buyers but also the economy as a whole.

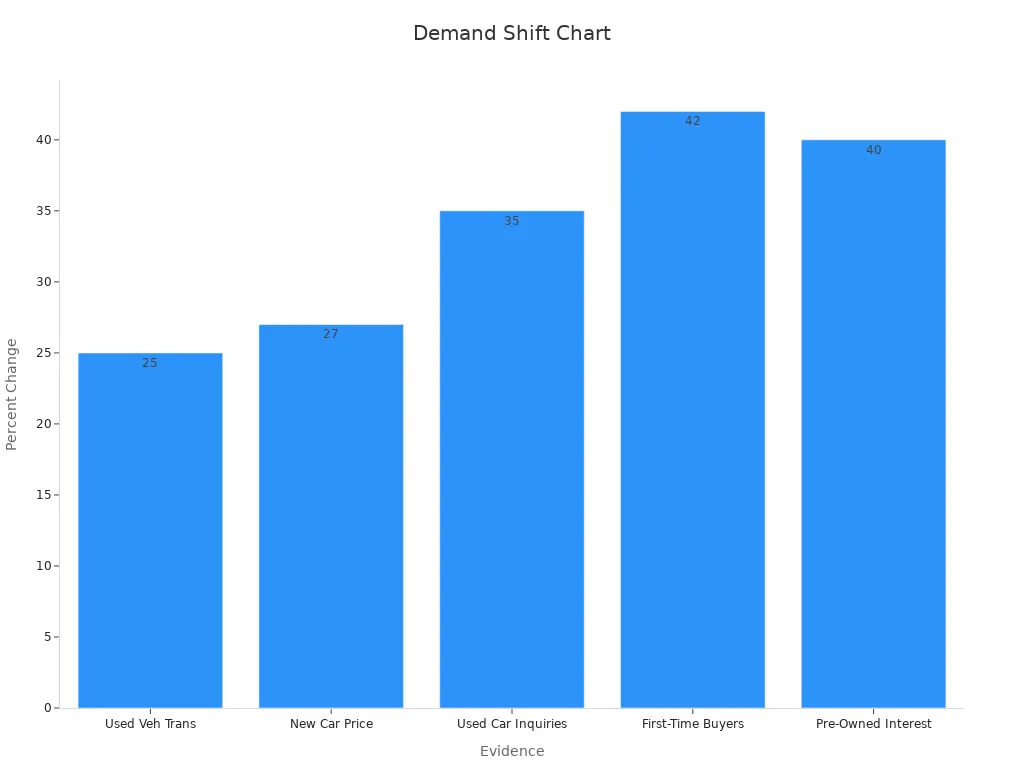

Shift in Consumer Demand Toward Used Vehicles

As new cars get more expensive, people are buying used cars instead. Studies show a 25% rise in used car sales compared to past years. New car prices have gone up by 27% since 2020, pushing buyers to choose pre-owned cars.

|

Evidence Type |

Data/Statistic |

|---|---|

|

Inquiries about used cars |

Increased by 35% |

|

First-time buyers of used cars |

Increased by 42% |

|

Average age of cars on the road |

Rose to 12.5 years |

|

Monthly payment for used car loan |

$382 at current rates vs. $425 at 2023 rates |

Car dealerships report a 40% rise in customers looking for cars priced $15,000 to $25,000. This shows how people are adjusting to higher car prices.

Broader Economic Risks and Inflationary Pressures

The tariff policy has caused prices to rise across the economy. Higher car and part prices have added to inflation. Experts say tariffs on Canada, Mexico, and China could raise inflation by 0.5 to 0.8 percentage points.

|

Tariff Scenario |

Estimated Impact on Core PCE Inflation |

|---|---|

|

2018 Tariffs |

0.1 to 0.2 percentage points |

|

25% Tariff on Canada and Mexico, 10% on China |

0.5 to 0.8 percentage points |

|

60% Tariff on China, 10% on Rest of World |

1.4 to 2.2 percentage points |

These price increases hurt families’ ability to buy new cars. This pushes more people to buy used cars instead. Over time, these tariffs could make it harder for families to save money and slow down the economy.

Retaliatory Trade Measures and Global Trade Tensions

Responses from Major Trade Partners

The U.S. tariffs caused strong reactions from other countries. Nations like Canada, China, and the European Union fought back with their own tariffs. Canada taxed U.S. goods like farm products and packaged foods. China added taxes on U.S. soybeans and chicken, up to 25%. The European Union taxed U.S. goods like whiskey and corn at 25%. These actions changed how countries trade and forced them to rethink partnerships.

Southeast Asian nations, like Indonesia, built stronger trade ties with China and Europe. Latin American countries became more careful about making trade deals with the U.S. China took bigger steps by banning rare-earth exports and listing U.S. companies as “unreliable.” These moves show rising risks and a shift toward protecting national economies.

Escalation of Trade Conflicts

The trade fight has grown worse as countries keep retaliating. In April, the U.S. added new tariffs, like 34% on Chinese goods and 20% on European imports. Canada hit back with $30 billion in tariffs and plans for $125 billion more. China also taxed more U.S. goods, affecting many industries. These actions caused global markets to become unstable, with U.S. stocks dropping after tariff news.

The growing trade war has hurt investment in U.S. factories. Companies struggle to plan because tariff rules keep changing. This has slowed economic growth and raised risks, making global trade harder to manage.

|

Date |

Event Description |

|---|---|

|

April 2 |

U.S. announced 34% tariffs on China, 20% on EU, and 10% on all imports, raising trade worries. |

|

April 2 |

Canada added $30 billion in tariffs, with $125 billion more planned. |

|

February 4 |

China taxed more U.S. goods, hitting many industries. |

|

April 3 |

U.S. stock market dropped sharply after tariff announcements. |

Disruption of International Trade Systems

The U.S. tariffs have upset global trade systems, causing big changes. Experts warn that export-heavy areas, like Asia Pacific, will suffer. Poorer countries like Laos and Myanmar face tariffs as high as 49%, making things worse. Retaliation from other nations has shifted trade toward one-on-one agreements.

Experts say building a new trade system will be tough. The U.S. has changed its trade goals, moving away from old systems. This has created confusion for manufacturers and trade partners. The current tariffs are not new but are important in reshaping ties between major economies.

Winners and Losers in the Automotive Industry

Benefits for U.S. Car Makers

The U.S. tariff rules help carmakers like Tesla. Tesla builds most of its cars in the U.S., so it avoids many problems. It doesn’t pay extra for imported parts, keeping prices lower. Tariffs on foreign cars also make U.S. cars more attractive to buyers. This could mean more sales for American brands.

But, higher costs for materials like steel and aluminum are a problem. Companies like Ford and General Motors have said their costs are rising. Here’s how tariffs affect them:

|

Company |

Tariff Impact |

Result |

|---|---|---|

|

Ford |

Higher costs for steel and aluminum |

Negative |

|

General Motors |

Increased prices for cars sold outside the U.S. |

Negative |

|

Tesla |

Less affected due to U.S.-based production |

Positive |

While U.S. carmakers face less competition, they still deal with expensive materials and tricky supply chains.

Problems for Brands That Import Cars

Car companies that depend on imports face big challenges. Tariffs on foreign cars and parts have raised costs. These companies must either pay the extra costs or charge buyers more. This is like what happened in the 1980s. Back then, Japanese car brands took 21% of the U.S. market. American carmakers lost $6.2 billion in 1980, leading to layoffs and money troubles.

Today, brands that rely on imports can’t adjust quickly. Moving factories to the U.S. takes a lot of time and money. This makes them struggle with the higher costs caused by tariffs.

Luxury Brands Handle Costs Better

Luxury car brands are better at dealing with tariff costs. Their buyers usually have more money and don’t mind price increases. For example, Ferrari raised prices by 10%, but demand stayed strong. Experts say tariffs could add $3,500 to $12,000 to car costs. Even so, luxury cars remain popular, with prices now 10-12% higher than before tariffs.

|

Vehicle Type |

Current Price |

Price Increase |

|---|---|---|

|

Small Sedan |

$22,000 |

+$4,800 |

|

Mid-Size SUV |

$38,500 |

+$8,200 |

|

Luxury Import |

$72,000 |

+$18,500 |

Luxury brands use their high-end image to cover rising costs. They stay profitable even with today’s tough economy.

Mixed Reactions from Labor Unions

Labor unions have different views on the U.S. tariff policy. Some think it helps workers, while others see risks for jobs.

Unions for U.S. factory workers support the tariffs. They believe it might bring car production back to America. This could mean more jobs in factories and parts plants. Union leaders say higher tariffs on imported cars could help U.S. workers compete. A United Auto Workers (UAW) leader said,

“The tariffs give us a chance to rebuild U.S. factories and get better pay.”

But not all unions agree. Many worry about rising costs for materials and parts. These higher costs could make cars more expensive, lowering sales and cutting jobs. Workers in industries using imported parts fear companies might use robots or move jobs overseas to save money.

Key Concerns Raised by Labor Unions:

-

Job Security: Workers fear layoffs due to higher production costs.

-

Wage Stagnation: Companies might freeze wages to handle tariff costs.

-

Global Competition: Tariffs could hurt U.S. exports, risking export-related jobs.

Labor unions are split on the tariff policy’s effects. Some see it as a way to boost U.S. factories, while others worry about job losses and slower growth. This shows the need for fair trade rules that help workers and grow industries.

The U.S. car tariff policy has changed the global car market. It has messed up supply chains, raised car prices, and hurt trade between countries. Experts think inflation will rise by 0.3%, slowing economic growth to 1.3%. In places like Aguascalientes, Mexico, jobs could drop by 12-15% if factories make fewer cars. On the other hand, factories in Michigan with UAW workers might add 2,800 jobs, even with not enough workers.

These changes show how hard it is to predict U.S. trade rules. Car makers and trade partners struggle to plan as car prices rise by up to $12,200. This affects what people buy and how markets work.

1. Why did the U.S. create the 25% car tariff?

The U.S. made this tariff to help local carmakers. It wants companies to build more cars in the U.S., creating jobs and boosting industries.

2. How do tariffs change car prices for buyers?

Tariffs make building cars cost more. Car makers raise prices by $3,500 to $12,000. Because of this, more people are buying used cars instead.

3. Why is moving factories to the U.S. hard?

Moving factories costs a lot of money and needs skilled workers. The U.S. doesn’t give as much help as countries like China, making it harder for companies.

4. How do tariffs affect trade with other countries?

Tariffs have caused other countries like Canada and China to fight back. This has hurt global trade and made the economy less stable.

5. Do U.S. carmakers gain anything from tariffs?

U.S. carmakers like Tesla benefit because they face less competition. But, higher material costs still make things tough for all car companies.

See Also

Unveiling The Essential Automotive Features Of MCF5251CVM140

Three Key Transformations XCF01SVOG20C Brings To Automation

Understanding MC9S12DJ256MFUE Specs For Automotive Use Cases

Three Notable Features Of SPC5605BMLL6 And SPC5607BMLL6 ECUs

Enhancing Automotive Performance With NXP Microcontrollers MC9S12XEP100